Get the Most Bang for Your Buck Evaluating Mutual Fund Reviews When it comes to making investments, it is essential to conduct in-depth research and ensure that you are getting the highest possible rate of return on your money within the bounds of what is physically possible. Evaluating Mutual Fund Reviews

Examining the performance

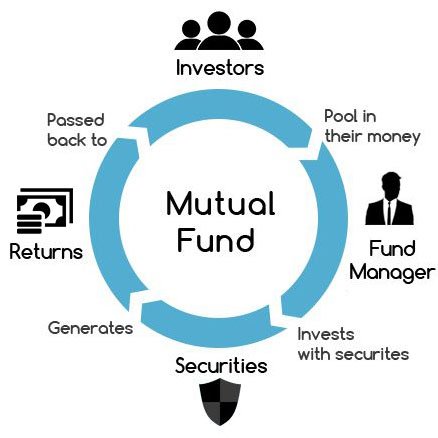

Examining the performance of several different mutual funds is one approach that is open to consideration in a scenario like this one. Whether you are just starting in the world of investing or are trying to extend the scope of what you already have in your portfolio, mutual funds are an excellent option to consider and should be one of your first choices. Evaluating Mutual Fund Reviews. read more

Evaluating Mutual Fund

Before engaging in any financial transaction, you should always make it a point to check that the money you are investing is going into the appropriate fund.

When researching the relative merits of various types of mutual funds, it is vital to consider a few key points. Evaluating Mutual Fund Reviews

Investigate the fund’s track

Your first item of business should be to investigate the fund’s track record to determine whether it possesses a credible history of performance in the past. It would help if you looked for mutual funds that have consistently provided returns that have historically been higher than those of the market over the past several years. This is an essential factor to consider when making investment decisions. Evaluating Mutual Fund Reviews

Before putting any of your money into the fund, you must examine its management team to ensure they have the necessary skills. Think about placing your money into funds managed by seasoned specialists with a track record of effectively selecting investments that produce a profit and who have an excellent track record overall. These funds should have a solid track record overall.

When performing research on the relative merits of various mutual funds, it is vital to consider the costs associated with investing in the fund. This is because fees vary from fund to fund and can be substantial. Certain funds have very high fees, which can drastically cut into the earnings you gain from investing in those funds. Evaluating Mutual Fund Reviews

You should have a solid understanding of the costs involved with the fund and the influence these fees will have on the profits you obtain from investing in the fund. This is especially important because the costs may vary from one fund to another.

Last but not least, you need to consider whether the fund is a good fit for the objectives you have established for your investments.

This should not be considered the least important step, though. Because various funds work toward multiple goals, you need to be sure that the fund you are considering investing in is an excellent fit for those aims before you commit any money to it. This is because different funds work toward other goals. For instance, if you are looking for a fund that will reliably produce income, you should look for a fund that focuses on dividend-paying equities rather than other stocks.

This will increase the likelihood that the fund’s holdings will generate a dividend payment. Because of this, there is a greater possibility that the fund will maintain a consistent income level.

Reading evaluations of several mutual funds and devoting the necessary amount of time to do so will help you ensure that you are getting the most return on your investment dollar as is humanly possible.

Conclusion

Before investing in the fund, you need to ensure that you have a complete and thorough comprehension of the management team, the track record of performance, and the fees associated with the fund. Consider whether or not the fund can help you achieve the monetary objectives you have set for yourself in terms of investments.

If it can, you should put your money into it. You can ensure that you are investing in the appropriate funds and maximizing the return on your investments if you conduct sufficient research. You can do this by completing the necessary research. You may also ensure you get the most out of your assets by optimizing their return.

Leave a Reply