Rebalancing Portfolios The Role Of Annuities Rebalancing portfolios is an integral part of financial planning, and annuities are a great tool to help you do it.

Annuities can be used in many ways to create a balanced portfolio that meets your needs.

In this article, we’ll explore the role of annuities in rebalancing portfolios.

We’ll look at how they work, what types of annuities exist, and why they may be a good choice for someone looking to diversify their investments.

Rebalancing Portfolios The Role Of Annuities.

By understanding the basics of annuities and how they interact with other aspects of investing, investors can make informed decisions about whether or not to include them as part of their overall financial plan. read more

What is rebalancing?

Ah, rebalancing portfolios. What an excellent way to waste your time! The very thought of it is enough to make even the most diligent investor groan in frustration.

After all, who has the energy to monitor their investments and adjust them as needed constantly?

But if you want to maximize your returns while minimizing risk, taking the time to rebalance your portfolio periodically is an absolute necessity. Rebalancing Portfolios The Role Of Annuities.

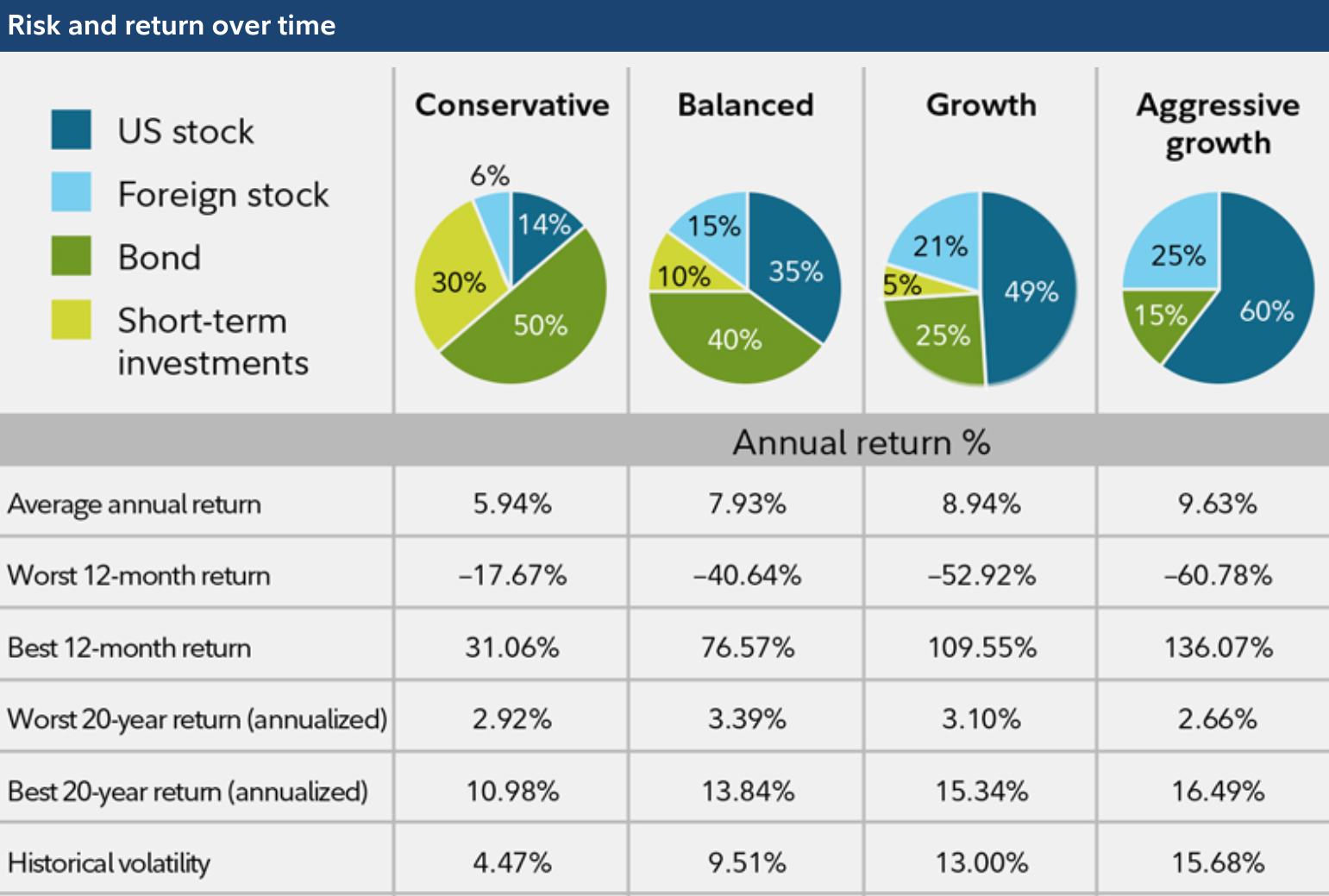

Rebalancing requires reviewing the stocks, bonds, mutual funds, and other assets in your portfolio and redistributing them so that each asset class remains within its target weight or range.

This means selling some of what’s overweighed and buying more of what’s underweighted, which can be tedious work! Rebalancing Portfolios The Role Of Annuities.

To complicate matters further, there are different strategies for choosing how often one should rebalance; no matter what method one chooses, investors must understand why rebalancing is essential and how annuities fit into the equation. Rebalancing Portfolios The Role Of Annuities.

What is an annuity?

An annuity is a financial product that provides regular income payments over an extended period. It can be used for retirement planning or to supplement other sources of income in retirement.

Annuities are usually purchased with a lump-sum payment and then provide periodic payments throughout the contract’s life.

These payments may include interest, dividends, principal, and insurance coverage. Rebalancing Portfolios The Role Of Annuities.

Annuities can help individuals achieve their goals by providing a steady income stream during retirement. Annuities also offer several advantages when it comes to portfolio rebalancing.

Because the periodic payments are fixed, they can be used as a hedge against market volatility.

This means that even if the value of your investments fluctuates significantly, you will still receive consistent monthly payments from your annuity. Rebalancing Portfolios The Role Of Annuities.

Additionally, some annuities come with guarantees on minimum rates of return (usually around 3-5%), which can help ensure your long-term wealth preservation objectives are met even if markets decline drastically over time.

How do annuities work?

In the previous section, we discussed what an annuity is and why it should be considered part of a rebalancing portfolio. Now let’s look at how annuities work to understand their role even further.

At its core, an annuity is an insurance contract between you (the buyer) and the issuer (usually an insurance company).

The idea behind this type of agreement is that you make regular payments over time in exchange for guaranteed income upon retirement or other predetermined circumstances. Rebalancing Portfolios The Role Of Annuities.

This makes them different from traditional savings accounts since the money can only be withdrawn when certain conditions have been met, such as reaching age 65 or another specified milestone.

Additionally, most annuities come with tax benefits—you don’t pay taxes on any gains until they are withdrawn. Rebalancing Portfolios The Role Of Annuities.

When choosing an annuity for your portfolio, it’s essential to carefully consider all your options to get the best deal possible.

Read through the terms and conditions before signing anything, and remember that there may be fees associated with these products.

It also pays to shop around and compare different offers to find one that works best for you—that way, you’ll know that not only are you getting good value but also peace of mind knowing your future financial security is taken care of. Rebalancing Portfolios The Role Of Annuities.

What Are the Different Types Of Annuities?

Imagine a beautifully crafted jigsaw puzzle. You have all the pieces in your hands; it may seem like an overwhelming task until you arrange them into their rightful places.

In much the same way, rebalancing portfolios is similar: without taking into account annuities to provide stability and structure, it can be a daunting challenge.

Annuities are financial instruments that provide guaranteed income for a specified period or throughout the lifetime of someone. Rebalancing Portfolios The Role Of Annuities.

They come in many forms and types—immediate annuities, deferred annuities, and fixed index annuities, to name a few—each providing different benefits depending on one’s specific needs.

When used correctly, they can offer investors steady cash flow at retirement while helping them achieve their long-term goals and protect against market volatility.

In short, when considering how best to manage portfolios concerning long-term savings plans or investments, annuities should not be overlooked as part of the equation; instead, they should be embraced as integral components that will help ensure success over time. Rebalancing Portfolios The Role Of Annuities.

Why Are Annuities Used for Rebalancing Portfolios?

Annuities have become a popular tool for rebalancing portfolios. They provide an effective way to maintain a portfolio’s risk-return balance and stability over time.

Annuities also help people protect their investments against market volatility while providing them with steady income streams in retirement.

Essentially, annuities are contracts between individuals and insurance companies that guarantee the investor regular payments at predetermined intervals—usually monthly or annually—until they die or reach a certain age.

This makes them perfect for retirees who need consistent cash flow from their investments. Furthermore, annuities can be used to reduce the risks associated with stock market fluctuations by ensuring returns remain relatively stable over more extended periods.

In addition to this, annuities may offer tax advantages, depending on where you live.

All these factors make them attractive options for those looking to rebalance their portfolios without taking on excessive risk levels.

When Should An Annuity Be Used For Rebalancing?

An annuity can be an excellent tool for rebalancing portfolios as it provides a steady income stream. It’s important to consider when an annuity should be used to maximize the benefits of portfolio rebalancing.

Generally, annuities should be employed if there is a need for ongoing cash flow from investments or concerns about longevity risk and outliving one’s savings.

Annuities also protect against market volatility, which may make them attractive for those who want less fluctuation in their investment returns.

When considering whether an annuity should be employed for portfolio rebalancing purposes, investors must assess their financial situation and objectives, which include examining liquidity needs and long-term goals such as retirement planning.

Ultimately, each investor needs to weigh the pros and cons of using an annuity within the context of their circumstances before making any decisions. Rebalancing Portfolios The Role Of Annuities.

What Are the Benefits of Rebalancing with Annuities?

Rebalancing portfolios with annuities can be a great way to ensure a person’s secure financial future. By taking the time to adjust and reallocate assets, investors can help maximize returns on their investments while minimizing risk.

It’s like using a life preserver for your finances; it provides stability and security in turbulent times.

Annuities offer an additional layer of protection by providing reliable income streams during retirement or when liquidity may be scarce.

They can also serve as an effective hedge against inflation, ensuring that retirees are kept up financially. Investing in annuities is one surefire way to guarantee a comfortable retirement without worrying about market volatility or fluctuations.

What Are the Risks of Rebalancing With Annuities?

Rebalancing with annuities can be an effective way to manage a portfolio, providing diversification and helping to reduce risk. However, it is crucial to understand the potential risks associated with this strategy.

The primary risk of investing in an annuity is that you may need help accessing your money when needed. Some grants have surrender charges or early withdrawal penalties if you attempt to withdraw funds before a particular time has passed.

Additionally, any fees paid for managing the annuity will erode the value of your investments over time, so it’s essential to factor these into your financial equation.

Finally, annuities may limit the amount of control you have over how your assets are allocated and managed; At the same time, many offer flexibility in terms of investment options; they generally require investors to make their decisions within pre-defined parameters set by the insurer.

How Can Investors Decide If Annuities Are Right For Them?

Regarding rebalancing portfolios, annuities can be an excellent option for investors. The benefits are numerous: they provide lifelong income, reduce the risk of outliving your savings, and allow you to diversify assets while taking advantage of tax-deferred growth opportunities.

Ultimately, though, deciding if an annuity is suitable for any particular investor requires careful consideration of their needs and financial goals.

The first step in determining what type of annuity might be appropriate is assessing the individual’s risk tolerance level and overall financial picture.

This includes understanding how much money will need to be invested upfront versus how much later on, when cash flow may become more restricted due to retirement or other life events. It’s also important to consider liquidity constraints, such as whether funds can easily be accessed in emergencies or for long-term care expenses.

Considering all these factors should help determine which form of annuity would best suit the investor’s specific situation.

What other options exist for rebalancing portfolios?

Rebalancing portfolios is essential for those looking to secure their financial futures. However, there are other options available for portfolio rebalancing than annuities.

Professionals specializing in this field can help individuals determine what best suits their needs, whether it be a stock and bond mix or mutual funds. Investment advisors have access to the most up-to-date information concerning investments.

They can use this knowledge to recommend strategies that will maximize returns on investment while minimizing risk at the same time.

They can also advise about the tax implications of various types of investments and suggest asset allocation models depending on an individual’s goals and risk tolerance level. Ultimately, working with a professional advisor is one of the best ways to ensure your long-term success in portfolio management.

Conclusion

Investors considering rebalancing their portfolios should consider annuities as a viable option. Annuities offer many potential benefits, such as providing income and protecting against market volatility, but they also come with risks.

It’s essential to weigh these pros and cons carefully before making any decisions about using annuities for portfolio rebalancing. Ultimately, each investor must decide what works best for them and ensure that the chosen approach aligns with their overall financial goals.

With so many options available, it can be challenging to choose which route is correct, but if done wisely, rebalancing your portfolio can help you reach your dreams in no time!

Leave a Reply