Tactical vs Strategic Asset Allocation with Annuities Asset allocation is a crucial concept in investing, serving as the bedrock for most financial plans. Annuities, as an investment product that promises a steady income stream, play a pivotal role in this arena. This article explores the intricacies of tactical and strategic asset allocation and how annuities fit into these paradigms. Tactical vs Strategic Asset Allocation with Annuities.

II. Understanding Asset Allocation

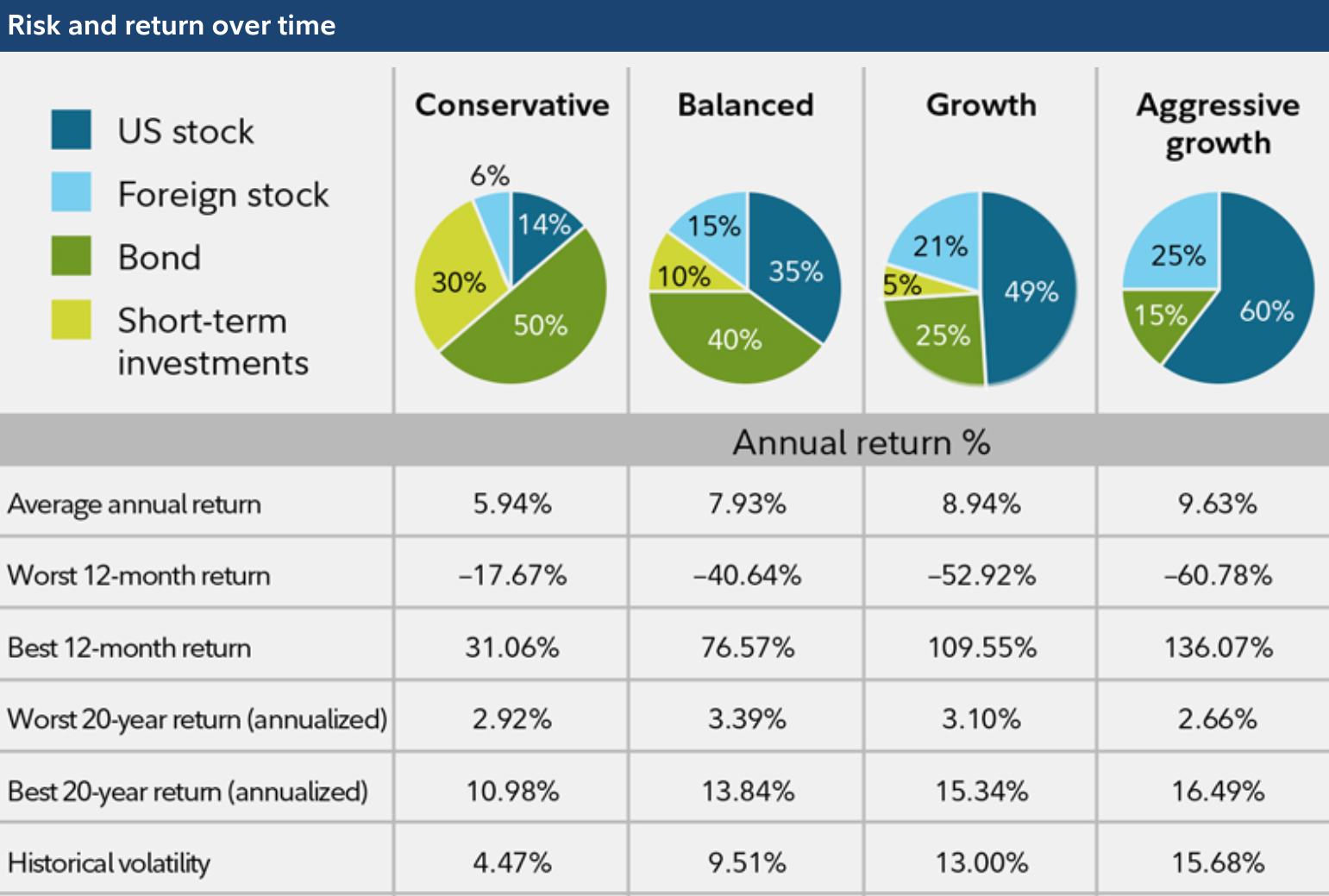

In simple terms, asset allocation involves dividing your investments across various asset classes—like stocks, bonds, cash, or annuities—to strike a balance between risk and return. This balance is tailored to your financial goals, risk tolerance, and investment horizon, thus shaping your overall investment portfolio.

III. Tactical Asset Allocation (TAA)

Tactical asset allocation is a more active investment strategy that aims to exploit market inefficiencies by temporarily deviating from a strategic asset mix to capitalize on perceived investment opportunities. For instance, if bonds are seen as attractive, a TAA investor may temporarily increase their bond allocation. Tactical vs Strategic Asset Allocation with Annuities.

However, TAA has its downsides—it requires accurate timing, and the transaction costs can add up. Including annuities in TAA provides stability, offsetting some risks associated with this active strategy. Consider the case of John, a TAA investor who uses fixed annuities to provide a steady return despite the market’s volatility.

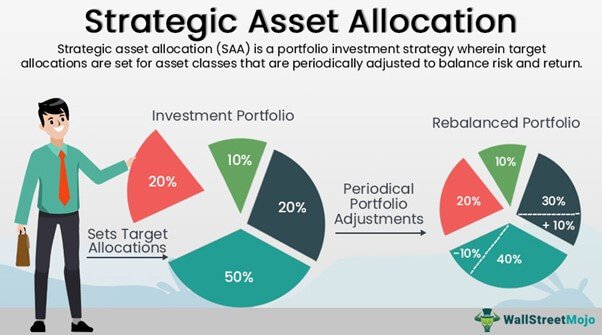

IV. Strategic Asset Allocation (SAA)

SAA takes a longer-term view, setting and maintaining a fixed asset mix based on your investment goals and risk tolerance. This strategy believes in the market’s efficiency over time and often involves periodic rebalancing to keep the initial asset mix intact. Tactical vs Strategic Asset Allocation with Annuities.

While less complex and time-intensive, SAA carries its own risks, particularly if the market undergoes significant changes. Here, annuities can provide a safety net. For example, an SAA investor, Jane, uses variable annuities to keep up with long-term inflation trends, ensuring her buying power remains consistent. Tactical vs Strategic Asset Allocation with Annuities.

V. Comparing Tactical vs. Strategic Asset Allocation

While tactical and strategic asset allocations aim to maximize returns and mitigate risk, their approaches vary significantly. TAA seeks to outperform the market by taking on more risk and requiring more active management. On the other hand, SAA takes a ‘buy and hold’ approach, riding out market volatility over the long term.

VI. Using Annuities in Tactical and Strategic Asset Allocation

Annuities play an essential role in both TAA and SAA. Their ability to provide a steady income stream can bring stability to a tactical portfolio and help them meet long-term financial goals strategically. The guaranteed income from annuities can also provide a buffer against market volatility, making them a valuable tool in asset allocation.

Tactical asset allocation is a more active investment strategy that aims to exploit market inefficiencies by temporarily deviating from a strategic asset mix to capitalize on perceived investment opportunities. For instance, if bonds are seen as attractive, a TAA investor may temporarily increase their bond allocation. Tactical vs Strategic Asset Allocation with Annuities.

However

However, TAA has its downsides—it requires accurate timing, and the transaction costs can add up. Including annuities in TAA provides stability, offsetting some risks associated with this active strategy. Consider the case of John, a TAA investor who uses fixed annuities to provide a steady return despite the market’s volatility. Tactical vs Strategic Asset Allocation with Annuities.

VII. Conclusion

Tactical and strategic asset allocation offer unique ways to approach investing in annuities. Whether you’re an active investor seeking to exploit market trends (TAA) or aiming for long-term growth and stability (SAA), annuities can play a vital role in achieving your financial goals. As always, your choice between tactical and strategic asset allocation should reflect your financial objectives, risk tolerance, and investment horizon. Tactical vs Strategic Asset Allocation with Annuities.

Leave a Reply