Ensuring Portfolio Diversification With Annuities Investors are always looking for ways to diversify their portfolios and mitigate risks. Annuities can be a great way to do so, as they provide an additional layer of security that other investments may lack.

This article will discuss how annuities can help ensure portfolio diversification and explain their benefits. Ensuring Portfolio Diversification With Annuities.

Annuities have become increasingly popular among investors in recent years due to their ability to guard against market volatility while providing steady income streams over time.

In this article, we’ll look at what annuities are, how they work, and explore why it’s essential to consider them when creating your investment strategy. Ensuring Portfolio Diversification With Annuities.

What Are Annuities?

Annuities are a type of financial product that can provide reliable income for retirement.

An annuity is an agreement between you and an insurance company where your money is exchanged for payments at regular intervals over time.

Annuities are like a contract with the insurer: they guarantee a steady flow of income throughout retirement, and if you die before receiving all your payments, any remaining ones will be passed on to whomever you’ve designated as beneficiary. Ensuring Portfolio Diversification With Annuities.

Annuities offer several benefits beyond their guaranteed income stream; these include tax-deferred growth, asset protection from creditors in certain situations, and estate planning flexibility. Ensuring Portfolio Diversification With Annuities.

Additionally, they have fewer risks associated with them than other types of investments because the insurance company assumes the responsibility for investing and managing the funds within the annuity policy. Ensuring Portfolio Diversification With Annuities.

Annuities can be an attractive option for investors looking to diversify their portfolios while having access to secure income during retirement.

Types Of Annuities

Annuities are a powerful tool for diversifying your portfolio. With annuities, you can spread your money across multiple investments and enjoy the benefits of both fixed-income and growth options. It’s an excellent way to protect yourself against market volatility and ensure that your savings will be there when you need them most.

When it comes to annuities, there are several different types available. You can choose from immediate or deferred annuities, variable or indexed annuities, income riders, longevity insurance policies, joint life contracts – the list goes on. Ensuring Portfolio Diversification With Annuities.

Each type of annuity has advantages and disadvantages, which should be carefully considered before deciding which one is right for you. Ultimately, understanding the features of each type of contract is essential to make an informed purchase decision that meets your needs and goals.

Benefits Of Annuities

When protecting and growing your retirement savings, annuities can be a powerful tool in creating the secure financial future you’ve been dreaming of. Offering security and flexibility, these insurance-backed products allow you to diversify your portfolio confidently. Ensuring Portfolio Diversification With Annuities. read more

An annuity is an agreement between yourself and an insurance company that pays out a fixed or variable income throughout your lifetime – regardless of market conditions or other external factors. With this type of product, you can enjoy peace of mind knowing that you will always have access to a steady income stream in retirement, even if stock markets dive. Ensuring Portfolio Diversification With Annuities.

Furthermore, many annuities come with additional features such as inflation protection which helps ensure that your purchasing power remains strong throughout retirement. Ultimately, annuities offer investors the chance to lock in their gains from decades’ worth of hard work while providing them with critical safeguards against unexpected risks down the road.

Risks Of Annuities

When considering the purchase of an annuity, it is essential to be aware of the risks associated with them. Annuities can involve significant fees and commissions that need to be considered when assessing whether they are a good fit for your portfolio and overall financial situation.

Additionally, annuities may come with limits on liquidity depending on the type chosen — some will restrict or even prohibit access to funds during specific periods.

It’s also critical to consider any restrictions imposed by tax laws surrounding annuities, as many have specific rules governing how long you must hold them before withdrawing money without incurring penalties. Ensuring Portfolio Diversification With Annuities.

Furthermore, since most annuities don’t offer protection against inflation, their value could erode over time if prices increase significantly in the future. Ensuring Portfolio Diversification With Annuities. read more

It’s essential to weigh all these factors carefully before committing to an annuity contract to make an informed decision based on the potential risks versus rewards.

Who Should Invest In Annuities

Annuities can be an excellent way for individuals to diversify their portfolios and provide financial security in retirement. They offer the unique benefit of guaranteed income, which helps protect against market downturns or unexpected life events.

Generally speaking, anyone looking for an alternative form of investment with steady returns should consider annuities as part of their portfolio. The decision to invest in annuities shouldn’t be taken lightly, though; it’s essential to research various options carefully before committing any money. Ensuring Portfolio Diversification With Annuities.

It’s also essential that prospective investors clearly understand how much they can contribute and what type of payout structure makes sense for them. Additionally, those interested in purchasing an annuity should consult a qualified financial advisor who knows the different types available and can help determine if one is right for them. Ensuring Portfolio Diversification With Annuities.

How To Invest In Annuities

Investing in annuities is like planting a garden. You take the time to carefully plan and cultivate each seed, ensuring the ground is suitably prepared for optimal growth.

As you tend your growing investment portfolio with annuities, it will become more diverse and bear greater returns over time.

When investing in annuities, it’s important to remember that there are many different varieties available on the market today.

There are immediate annuities that offer payouts right away and deferred annuities that provide rewards further down the line. Ensuring Portfolio Diversification With Annuities.

Variable annuities enable investors to spread their risk across an array of mutual funds or other investments, while fixed-indexed annuities provide guaranteed gains based on changes in specific indexes.

All these factors can help ensure a diversified portfolio tailored to individual needs and goals.

Tax Considerations

When considering annuities as part of a portfolio diversification strategy, it is essential to be mindful of the tax implications.

All fixed and variable annuity products are subject to federal income taxes, though there may be some differences in how different types of annuities are taxed at the state level.

In many cases, withdrawals from an annuity will count toward taxable income for that year.

It’s essential to understand all applicable taxes before taking out money so you can plan accordingly.

Additionally, many states have rules regarding the taxation of inherited or gifted annuities, making this another factor to consider when deciding whether or not to purchase one as part of your portfolio diversification efforts.

Ultimately, it pays to research and speak with a professional about any tax concerns before investing in an annuity product.

Finding The Best Annuity

Investing in annuities is one of the most reliable ways to diversify a portfolio and secure future income. But, with so many options available, it can be not easy to know which type of annuity best suits your needs and financial goals.

One theory that has been gaining traction is that variable annuities are more suitable for those looking for higher returns than fixed-rate products due to their potential growth opportunities.

To determine if this idea holds, you must consider the risks and rewards associated with each type of annuity product before making any decisions.

A critical factor in deciding whether or not a variable annuity is right for you is understanding how much risk you’re comfortable taking on – as these products involve investing part of your savings into stock markets and other investments where prices can fluctuate significantly over time.

On the other hand, investing in variable annuities could yield greater returns than traditional fixed-rate products.

Ultimately, it’s essential to evaluate all the factors carefully when making an informed decision about which option works best for your individual situation.

Using Annuities For Retirement

Annuities are a great way to diversify your retirement portfolio and ensure financial stability for years to come.

An annuity is an insurance product that provides regular payments over time, usually after you retire from work.

The payments can be based on either a fixed amount or the investment returns of the underlying assets in the annuity contract.

With annuities, you can receive steady income without having to worry about stock market volatility or other risks associated with investments.

You can purchase an annuity through life insurance companies, banks, mutual funds, brokers, and even the government.

It’s essential to thoroughly research different types of annuities before investing to understand precisely how they work and what kind of return you’ll get from them.

You should also consult a financial advisor who can guide you on which type of annuity best suits your needs and goals.

Annuities can be a powerful tool for ensuring financial security during retirement – provided they are used wisely.

Annuities As Part Of An Investment Strategy

Regarding retirement planning, annuities can be an excellent tool for providing financial security. They offer the potential of steady payments over time and are often used when individuals need additional income during their golden years.

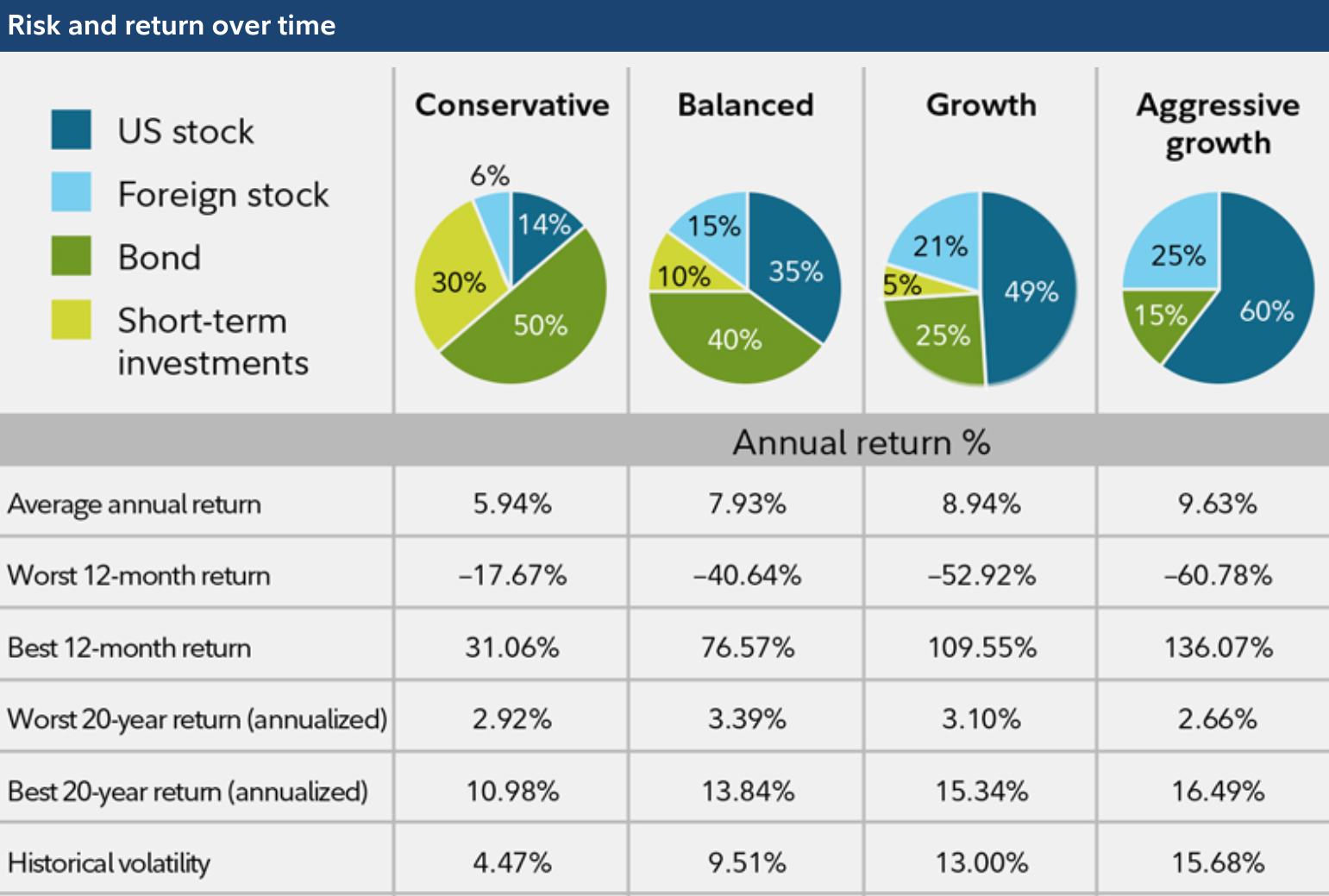

However, annuities can also play an essential role in overall investment strategy. Annuities can be an effective way to diversify your portfolio and reduce risk. This is because they provide guaranteed returns that don’t vary with stock market performance or economic trends.

As such, having a portion of your portfolio invested in annuities can help protect you from fluctuations in other investments. Furthermore, since annuity payments are typically made regularly, they may stabilize your financial plan. Ultimately, including annuities as part of your investment strategy could bring peace of mind by helping ensure you have access to reliable funds throughout retirement.

Conclusion

Annuities are an effective way to diversify your portfolio and ensure a secure retirement. They can help you manage risk, maximize returns, and minimize taxes. But they aren’t for everyone; it’s essential to understand the risks before investing in them.

Ultimately, if you’re looking for security and peace of mind during your golden years, annuities may be the ticket. So go ahead take advantage of this powerful financial tool!

Leave a Reply