Mutual Funds With Dividends Hi there! If you’re looking for an investment option to help grow your money, mutual funds with dividends may be just what you need.

Dividend-paying mutual funds are a great way to have a steady income while also investing in the stock market, and they can be a brilliant addition to any portfolio. Mutual Funds With Dividends

In this article, I will explain why investing in dividend-paying mutual funds could benefit you.

Whether you’re new to investing or an experienced investor, understanding how these investments work is essential for making the most of them. read more

So let’s dive into it! Mutual Funds With Dividends

What Are Dividend-Paying Mutual Funds?

Investing in mutual funds can significantly diversify your portfolio and take advantage of the stock market. But if you’re looking for an even more lucrative option, dividend-paying mutual funds may provide the boost you need. Mutual Funds With Dividends.

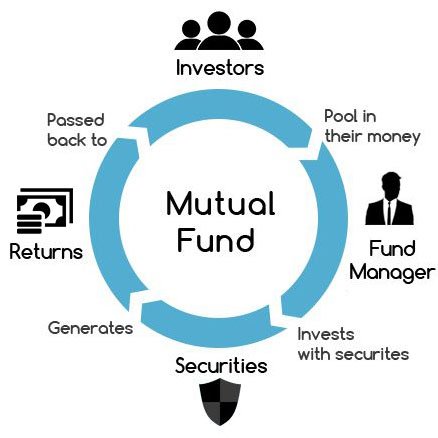

Dividend-paying mutual funds are investment vehicles that generate income through dividends from the stocks they own. They offer investors steady returns over time and potential growth in capital investments. Dividend-paying mutual funds allow investors to get exposure to many different companies at once while still being able to collect dividends on their holdings. Mutual Funds With Dividends. read more

These types of investments typically have lower risks than individual stocks because they are broadly diversified and managed by professionals who keep track of changes in the markets. Additionally, since these funds pay out regular dividends, investors can rely on this extra income stream, often more significant than one could make with other investments such as bonds or bank accounts. Mutual Funds With Dividends.

Advantages of Investing in Dividend-Paying Mutual Funds

Investing in dividend-paying mutual funds offers several advantages to help you reach your financial goals. Here are four key benefits to investing in these types of investments:

1. Access to professional money management: By investing in a dividend-paying mutual fund, you’ll get access to experienced professionals who manage the fund and choose which securities they invest in to maximize profits for investors. Mutual Funds With Dividends.

2. Diversification: Mutual funds offer instant diversification by pooling hundreds or thousands of stocks, bonds, and other assets. This helps reduce risk since gains in another may balance losses on one security.

3. Regular income streams: With dividend-paying mutual funds, you’ll receive regular payments from dividends paid out by companies within the fund’s portfolio. These payments come directly from the earnings generated by those companies rather than from any return on investment generated through selling shares at higher prices later down the road.

4. Ability to reinvest returns: When dividends are received, you can reinvest them into additional units of the same fund for potentially more significant future returns without incurring more fees or taxes on capital gains when selling off existing units. Mutual Funds With Dividends.

These features make dividend-paying mutual funds a great way to add stability and growth potential to your overall portfolio while generating an extra income stream. Investing in these types of funds is worth considering as part of your long-term wealth-building strategy. read more

Disadvantages of Investing in Dividend-Paying Mutual Funds

Investing in dividend-paying mutual funds can be a great way to earn income, but it also comes with some risks. For starters, the dividends you receive depend on the fund’s performance, so if your fund’s investments don’t do well, your returns won’t either. Mutual Funds With Dividends.

Furthermore, when markets are volatile, and stock prices are dropping quickly, there’s no guarantee that dividend payments will remain steady or increase as expected. That means you could experience significant losses due to dividend payments even in an otherwise profitable period for investing. Mutual Funds With Dividends.

Another potential downside is that certain types of mutual funds require higher minimum investments than others. This may make them out of reach for smaller investors who need help to afford those high initial deposits.

Additionally, because many dividend-paying funds come with higher management fees than other types of mutual funds, they may not be the best choice if you’re looking to maximize long-term gains from your investment capital. All of these factors should be carefully weighed before deciding whether this type of investment is right for you. Mutual Funds With Dividends. read more

How to Choose the Right Dividend-Paying Mutual Fund

The disadvantages of investing in dividend-paying mutual funds have been discussed. However, despite those drawbacks, these investments can still be an excellent opportunity for someone seeking regular income.

It’s like the old saying goes: ‘You’ve got to take the bad with the good.’ So how do you pick the right fund? Well, it’s all about understanding your financial goals and deciding what features are important to you.

To determine which type of dividend-paying fund is best for you, start by weighing risk tolerance versus return expectations.

Some investors prefer high-risk/high-reward stocks that offer more significant dividends at a higher cost; others may opt for low-risk options that provide steady returns over time.

Evaluate past performance, too; look back at the track record of any potential fund before taking the plunge.

Finally, remember to check the fees! Bigger doesn’t always mean better when it comes to investment rewards, so choose wisely and ensure each dollar counts towards achieving your long-term goals.

Risk Factors to Consider When Investing in Dividend-Paying Mutual Funds

I’m sure you’ve heard the adage that nothing in life is certain except for death and taxes. In investing, there needs to be a guarantee of success, especially regarding dividend-paying mutual funds. But if done right, these investments can be a great way to grow your portfolio over time.

When considering any investment strategy, risk should always be top of mind. With dividend-paying mutual funds, some risks include volatility due to market conditions, a lack of liquidity, and the possibility that dividends may not continue to be paid out at their current rate or even stop altogether.

It’s essential to do your homework on each fund before jumping in so you know what you’re getting into. Researching fees and expenses associated with a given fund is also essential because they can eat away at returns. Mutual Funds With Dividends.

Ultimately, understanding how much risk makes sense for your situation will help ensure you decide which dividend-paying mutual fund is right for you.

Tax Implications of Dividend-Paying Mutual Funds

I’m curious to learn more about the tax implications of dividend-paying mutual funds.

I know that the tax treatment of dividend income is based on whether the revenue comes from qualified or nonqualified dividends, and I’d like to learn more about that.

I’m also interested in hearing about any tax-efficient investing strategies related to these types of mutual funds. Mutual Funds With Dividends.

Tax Treatment of Dividend Income

If you’re considering investing in a dividend-paying mutual fund, it’s essential to understand the tax implications.

Regarding taxes on dividend income from mutual funds, there are two main factors to consider: your marginal rate and qualified vs. nonqualified dividends.

Qualified dividends receive preferential treatment when it comes to taxation, so if that applies to you, congrats!

Nonqualified dividends are taxed at your ordinary income tax rate, which means you might have more of an obligation come April 15th.

Regardless of whether or not they’re qualified, all dividend payments must be reported as taxable income by investors, so make sure you keep track of everything for smoother sailing when it comes time to file taxes.

Qualified vs. nonqualified dividends

It’s essential to understand the difference between qualified and nonqualified dividends regarding taxes on dividend income from mutual funds.

Qualified dividends are taxed at a lower rate than your ordinary income tax rate, so you’ll be thankful for that come April 15th! Mutual Funds With Dividends.

Nonqualified dividends, however, are taxed as regular income, meaning they can add up quickly if you need to be more careful.

Keeping track of all your dividend payments is critical to ensuring you don’t owe too much in taxes come tax filing time.

So stay organized throughout the year to ensure everything goes smoothly!

Tax-Efficient Investing Strategies

Now that you’ve got the basics down let’s talk about some tax-efficient investing strategies.

If you want to keep more money in your pocket, there are a few key things to consider when it comes to dividend-paying mutual funds.

One of the most important is diversifying your portfolio; this can help spread out the taxes due on any dividends received by distributing them across different types of investments.

Another strategy is timing. If you know when each fund pays its dividends and plan accordingly, you can better manage how much you owe come tax time. Mutual Funds With Dividends.

Finally, another intelligent move would be to open up an IRA or 401(k) account so that all those investment earnings don’t get taxed until later.

Utilizing these tactics can go a long way toward minimizing what you owe Uncle Sam!

Tips for Investing in Dividend-Paying Mutual Funds

Investing in dividend-paying mutual funds is like taking a journey. It can be an exciting and rewarding experience if you know where to go and are prepared for the trip.

When investing in these types of mutual funds, you must do your homework first. Research each fund’s objectives and determine whether or not they align with your financial goals. Pay attention to fees associated with buying into the fund and any charges for selling out before maturity dates.

Determine how much risk you’re comfortable accepting so that even if there are market fluctuations, you won’t panic and sell prematurely. Also, look at which companies make up the fund portfolio; this will give you an idea of what kinds of dividends they’ll pay out while also allowing you to assess potential risks due to company-specific issues. Mutual Funds With Dividends.

Finally, review past performance reports and compare them against other investments with similar return expectations; this could save you time and money by helping you identify higher-performing options right from the start.

Investing wisely means being informed about all your choices, including those involving dividend-paying mutual funds. Taking some extra steps now can mean more successful returns later on!

Frequently Asked Questions

What Is The Minimum Amount Of Money Needed To Invest In Dividend-Paying Mutual Funds?

Investing in dividend-paying mutual funds can be a great way to generate additional income. But one of the questions many people have is, “What’s the minimum amount of money needed?

Generally speaking, you need at least $500 to invest in most dividend-paying mutual funds. However, it may vary depending on which fund you choose, and some might even require more than that.

So if you’re interested in investing in these types of funds, do your research beforehand to know how much money you’ll need.

What Is the Average Rate of Return for Dividend-Paying Mutual Funds?

Investing in dividend-paying mutual funds is a great way to earn returns on your money.

For example, John recently invested $10,000 in a dividend-paying mutual fund and made an average return of 6% after one year.

Generally speaking, the average rate of return for dividend-paying mutual funds is between 4% and 6%, depending on the type of investment and market conditions.

This means you could get higher returns than investing in other investments like stocks or bonds.

Are there special regulations or fees associated with investing in dividend-paying mutual funds?

When investing in dividend-paying mutual funds, there may be some special regulations or fees that you need to consider.

While these can vary depending on the type and size of the fund, you’ll want to do your research before you decide where to invest so you know exactly what requirements are expected of you.

It’s also important to look out for hidden costs of investing in a mutual fund

Knowing all this information ahead of time will help ensure that your investment is successful and profitable.

What Is the Difference Between Dividend-Paying Mutual Funds and Other Types of Mutual Funds?

If you’re looking to invest in mutual funds, it’s essential to understand the difference between dividend-paying and other types of mutual funds.

Dividend-paying funds are made up of stocks that issue regular payments known as dividends to shareholders. These payments usually come from the company’s profits or interest earned on bonds.

On the other hand, non-dividend-paying funds are typically composed of stocks that don’t offer regular dividend payouts but may have higher capital appreciation potential over time.

Both types of mutual funds can be great investment options, depending on your goals and risk tolerance.

Are there any special tax considerations for investing in dividend-paying mutual funds?

Investing in dividend-paying mutual funds is like hitting a two-for-one deal; you get the potential for gains with dividends to boot!

But when it comes to taxes, some special considerations come into play. You’ll want to look into factors such as whether your fund is paying qualified or nonqualified dividends and if the distributions from your fund will be taxed at ordinary income rates.

It’s also important to know what kinds of losses can be used to offset any gains so you don’t end up with an unexpected tax bill.

Conclusion

Investing in dividend-paying mutual funds is a great way to diversify your portfolio and earn extra income.

Even with the minimum required investment amount, you have the potential to make returns that are out of this world.

While specific regulations or fees may be associated with these investments, understanding them thoroughly before investing is vital to success.

Investing in dividend-paying mutual funds could lead to a financial windfall and give you peace of mind knowing that your money is growing responsibly.

Leave a Reply