Mutual Funds Vs Etf | What’s the Difference. Investing can be a great way to build wealth over time, but there are many different types of investments out there, and it can be hard to know which one is the best for you.

Mutual funds and exchange-traded funds (ETFs) are two popular options, but they have pros and cons that need to be weighed before making an informed decision.

In this article, I’ll look at mutual funds vs. ETFs—what they are, their advantages and disadvantages, and how they compare—so you can make the right investment choice for your financial goals.

What is a mutual fund?

Have you ever wondered what a mutual fund is and how it works? Well, let me tell you.

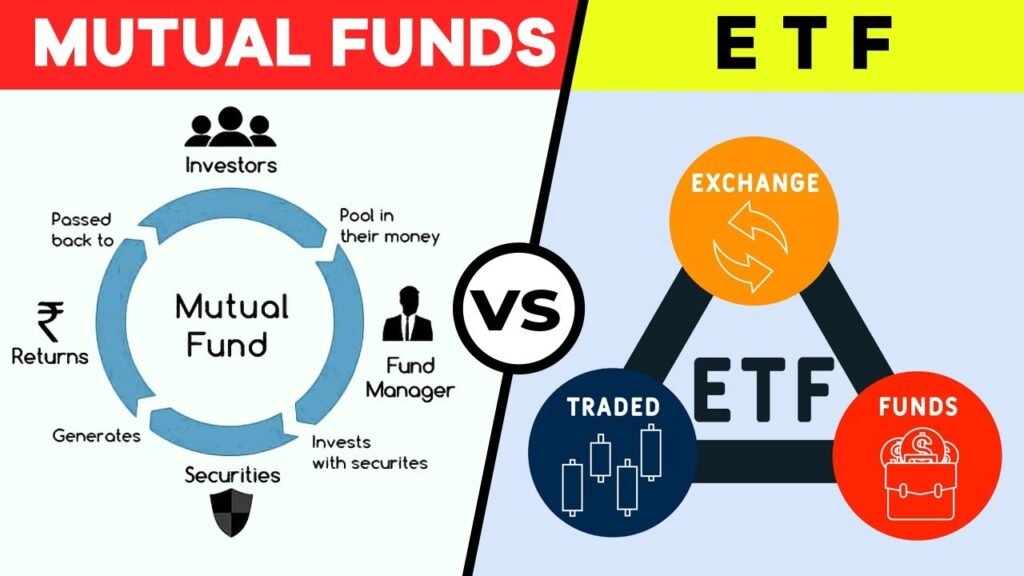

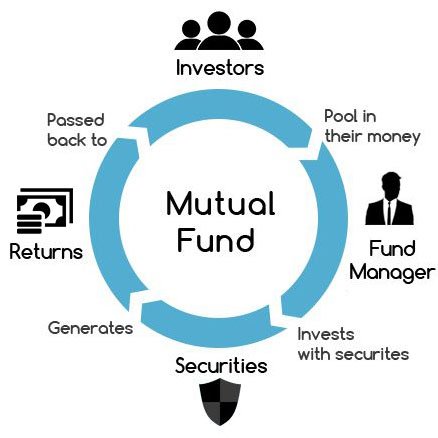

A mutual fund is an investment vehicle that pools your money with other investors’ to purchase securities like stocks, bonds, or other assets. It can be a great way for anyone, from beginners to experienced investors, to diversify their portfolios without having to invest huge sums of money.

When investing in a mutual fund, you are essentially buying into a portfolio composed of different investments such as stocks, bonds, and commodities. This means that when the price of one type of asset goes up or down, the effect on the overall value of your shares will be less drastic than if you had invested in only one security.

Mutual funds also offer professional management services that can help reduce risk while still providing potential returns.

What Is An Etf?

An ETF is an exchange-traded fund, and it’s a great way to invest your money. It’s a type of mutual fund that trades like a stock on the stock exchange.

I love ETFs because:

They’re more cost-effective than traditional mutual funds;

Their expense ratios are generally lower as well.

They provide you with access to thousands of stocks in one purchase, and

You can buy or sell them just like any other security throughout the day.

ETFs offer investors exposure to markets they may not have otherwise been able to participate in due to the high minimum investments required by individual companies. Plus, they come without the hassle of managing multiple accounts at different brokerages—all you need is one account!

So if you want diversification and convenience while keeping costs low, ETFs might be the perfect investment vehicle for you.

Advantages of Mutual Funds

Now that we’ve discussed what an ETF is, let’s look at the advantages of mutual funds.

Mutual funds offer investors a professional way to invest their money without having to actively manage it themselves. This can be beneficial for those who may not have a lot of time or experience in investing but still want to diversify their portfolio and grow their wealth.

Unlike ETFs, mutual funds are managed by professionals who make all decisions about which investments are purchased on behalf of the fund’s members. This allows investors to benefit from the expertise of these professionals and also gives them access to more diverse investment opportunities than they could get with just one individual purchase.

Furthermore, mutual funds often have lower operating costs, which can help reduce the overall expenses associated with owning the fund.

Advantages of ETFs

I love the cost efficiency of ETFs versus mutual funds. They’re often much less expensive, which allows me to get more bang for my buck.

Plus, ETFs usually offer tax benefits that mutual funds don’t, which can really help out with my taxes.

Finally, ETFs offer great portfolio diversification, so I know my investments are spread out and in good shape.

Cost Efficiency

Mutual Funds Vs Etf. When it comes to cost efficiency, ETFs are the clear winner. They usually come with much lower fees than mutual funds since they don’t have a team of managers actively trading and monitoring the fund’s investments. This means more money in your pocket!

Plus, you can buy and sell ETFs like stocks, which often incur fewer transaction costs than buying into or out of a mutual fund.

So if you’re looking for ways to save on investing costs, then ETFs should be at the top of your list.

With all that said, I’m sure you’ll agree that when it comes to savings, ETFs are hard to beat.

Tax Benefits

That said, there’s one more advantage we should discuss: tax benefits.

ETFs are much more tax-efficient than mutual funds since they don’t have to buy and sell investments as often.

This means you can keep more of your hard-earned money in your pocket come tax time.

Plus, if you hold an ETF for a long period of time, the capital gains taxes could be significantly lower than what you’d pay with other investment vehicles.

So it’s definitely worth considering when you’re deciding which type of investment is right for you.

All things considered, ETFs offer some pretty impressive advantages that make them an attractive option for many investors.

Portfolio Diversification

Now that we’ve touched on the tax benefits of ETFs, let’s talk about portfolio diversification.

With an ETF, you can invest in a wide range of assets all at once, giving your portfolio much more diversity than if you invested in just one asset class.

That way, even if some of your investments don’t perform well, you’ll still have some protection because other parts of your portfolio are doing better.

And this kind of flexibility is hard to get with other types of investments.

So it’s definitely worth considering when deciding which type of investment vehicle is right for you.

disadvantages of mutual funds

Mutual funds come with a few drawbacks.

First, they tend to have higher fees than ETFs. For example, mutual fund fees can range from 0.2% to 2%, while those of ETFs are usually around 0.1%. This difference in cost adds up over time and can take away from potential profits or add to losses.

Another disadvantage of mutual funds is that they require more management due to the fact that each investment must be actively monitored by a professional money manager. This means investors will need to pay additional costs for this service, which further reduces their potential return on investment.

Additionally, the timing of trades could cause some investors to incur extra taxes if held outside of retirement accounts.

* Capital Gains Taxes: If someone sells an asset at a gain (i.e., profit), then capital gains tax might apply when investing in a mutual fund as opposed to an ETF, where there is typically less trading activity inside them.

* Short-term Trading Tax Penalty: Mutual funds may also be subject to short-term trading penalties, meaning if you buy or sell within 12 months or less, you’re taxed at your marginal income rate instead of the long-term capital gains rate (which would normally apply after holding assets longer than 1 year).

Overall, it’s important for investors to understand all associated costs before making any decisions about investing in either type of product since both carry different levels of risk and reward depending on individual circumstances and goals.

Disadvantages of ETFs

It is often assumed that mutual funds are the only investment option available; however, this isn’t true. Exchange-traded funds (ETFs) also offer investors a variety of opportunities to diversify their portfolios and increase returns.

Mutual Funds Vs Etf. Even though they have similar goals, there are some distinct disadvantages associated with ETF investments. One issue with investing in an ETF is that it can be expensive to purchase them due to certain transaction fees. Unlike mutual funds, which can be sold at no cost, many brokers charge commissions for each individual trade placed on an ETF.

Additionally, if you’re looking for more specialized or niche investments, such as international stocks or commodities, there may not be enough options within an ETF portfolio to meet your needs. Furthermore, ETFs typically come with higher expense ratios than many other types of mutual fund investments, meaning less money in the investor’s pocket over time.

Lastly, while buying and selling shares in both mutual funds and ETFs carries market risk, ETFs tend to experience more volatility due to their active trading nature. As such, it’s important for investors who choose to use them to do so carefully and understand the risks involved before entering into any position.

Comparing Mutual Funds and ETFs

I’m sure you’ve heard of mutual funds and ETFs, but what’s the difference?

Mutual funds are a type of investment that pools money from many investors to buy stocks or bonds. They offer advantages like diversification and professional management; however, they can come with high fees that may reduce your returns over time.

On the other hand, exchange-traded funds (ETFs) are mostly made up of investments such as stocks, commodities, or bonds that are traded on an exchange. ETFs also provide diversification and potential tax savings but generally cost less than mutual funds due to lower overhead expenses. Unlike mutual funds, ETFs don’t require minimum investments and often trade at prices more closely aligned with market value since they’re listed on stock exchanges. That said, trading is not always free, and there could be additional costs associated with buying or selling shares.

So if you want a managed product with low transaction costs, investing in a mutual fund may be worth considering; just make sure you read through all the details so you know exactly what kind of fees you’ll face before making any decisions!

Alternatively, if you prefer greater flexibility when it comes to investing, then exchange-traded funds could be a better choice for you since they allow access to multiple asset classes without needing large amounts of capital upfront. Ultimately, though, it depends on your individual goals and risk tolerance, so think carefully about which route makes the most sense for your needs before committing to anything!

Frequently Asked Questions

What Is The Minimum Investment Required For A Mutual Fund Or Etf?

It all depends on what type of mutual fund or ETF you’re looking to invest in.

Generally, the minimum investment for a mutual fund is around $500–$1,000, and an ETF typically requires less than that, with some starting as low as $50.

It’s important to note that many funds have varying requirements, so it’s best to check exactly which one you are interested in before investing.

Are mutual funds and ETFs subject to capital gains tax?

If you’re looking to invest, it’s important to know if the gains you make will be subject to capital gains tax. That includes both mutual funds and ETFs.

So, are they taxable? Generally speaking, yes, they are all subject to taxes on your investment income. However, the specific amount of tax due depends on factors such as how long you’ve held an investment and the type of investment in question.

Can mutual funds and ETFs be used to fund a retirement account?

Making sure you have enough money for retirement is something we all want to do, and there are two investment vehicles that can help us achieve this: mutual funds and ETFs.

Whether these products can be used to fund a retirement account depends on the specific product in question, so it’s best to check with your financial advisor first before making any decisions.

Generally speaking, though, both mutual funds and ETFs offer great options when looking to invest in a retirement savings plan.

What Is The Management Fee Associated With Mutual Funds And ETFs?

When it comes to investing, one of the most important considerations is management fees.

So what are they when it comes to mutual funds and ETFs?

Generally speaking, mutual funds have higher fees than ETFs.

This is because the people in charge of mutual funds decide on their own which investments to buy or sell, while ETFs just follow an index.

However, depending on the type of fund you choose, there can be significant variations in fee structures for both types of investment vehicles.

How Often Do Mutual Funds and ETFs Pay Dividends?

When it comes to dividends, mutual funds and ETFs can vary.

Mutual funds typically pay out a dividend once per year, while some ETFs may pay you quarterly or monthly.

If regular income is important to you, then an ETF might be a better choice, as they tend to offer more frequent payments.

Conclusion

In conclusion, the decision between investing in mutual funds or ETFs can be a difficult one. Ultimately, it comes down to personal preference and an understanding of the investment products available.

Before making any decisions, it’s important to consider what your minimum investment is, whether there are capital gains taxes associated with either option if you’re using them for retirement purposes, as well as their management fees and dividend payout schedules.

When considering all these factors together, you’ll have a better idea of which strategy suits your needs best, so don’t hesitate to take some time out of your day to do research.

After that, you’ll be able to make an informed decision that will set yourself up for long-term success like a modern-day wizard!

Leave a Reply