Mutual funds versus index funds. Investing in the stock market can be a daunting task. It’s important to understand what different options you have when it comes to investing your money and making sure that your hard-earned cash is working for you.

Mutual funds and index funds are two popular options, but which one should you choose? In this article, I’ll compare mutual funds versus index funds so you can make an informed decision about where to put your money.

I’ll start by discussing what each option is and how they differ from each other. After that, I’ll explain the pros and cons of both so you know exactly what advantages or disadvantages might come with either choice.

Finally, I’ll provide some tips on how to decide between mutual funds and index funds based on your financial situation and goals. So keep reading if you want to make the best investment decisions for yourself!

What are mutual funds?

What a coincidence that you’re here to learn about mutual funds! It’s like the universe knew that was exactly what I wanted to talk about today.

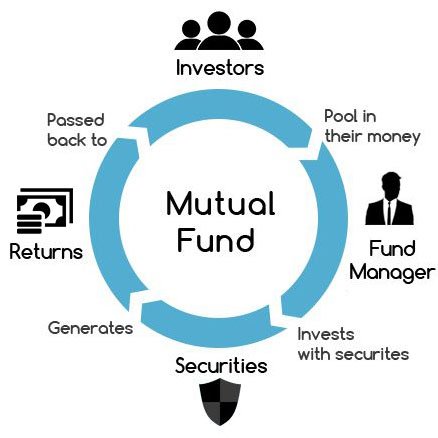

Mutual funds are an investment option that many people use because they can be less risky than other investments. They operate by pooling money from multiple investors and using it to purchase stocks, bonds, or other securities.

This gives small-time investors access to a portfolio of professionally managed investments without having to buy each security individually. It might seem intimidating at first, but investing in mutual funds is actually quite straightforward—all you have to do is decide which fund best meets your needs and then start contributing regularly with any amount of money that works for you.

Plus, there’s no need to worry if you don’t feel like you know enough about the stock market; most mutual funds are managed by professionals who make sure that your money is allocated properly so that your returns are maximized over the long term.

All in all, it’s hard not to see why mutual funds remain one of the top investment options out there!

What are index funds?

When it comes to investing, there are two main choices: mutual funds and index funds. Today we’re looking at index funds—what they are, how they work, and why you might want to consider them for your investments.

An index fund is a type of investment that tracks an underlying market index, such as the S&P 500 or Dow Jones Industrial Average. They tend to be low-cost and provide broad diversification since they hold more stocks than any individual investor could afford to purchase on their own.

Here are three advantages to index funds:

1. Lower fees: Index funds have lower management fees than most other types of investments, like mutual funds or ETFs;

2. Tax efficiency: Because fewer trades occur in an index fund due to its passive nature, investors often pay less capital gains tax;

3. Diversification: Investing in just one stock can be risky, but with an index fund, you get exposure to hundreds or even thousands of different companies without having to buy each one separately.

Index funds offer many benefits over traditional investments while helping you stay true to your long-term goals. If you’re looking for hassle-free investing with access to a diverse range of assets, then a well-managed index fund may be right up your alley!

Pros andcons Cons of mutual funds

I’m curious to hear what other people think about the pros and cons of mutual funds.

Let’s talk about the pros first, like diversification, professional management, and liquidity.

Then we can move on to the cons, like fees, lack of control, and risk of loss.

Pros: Diversification

Diversifying your investments is a great way to protect yourself against market volatility, and mutual funds are an effective tool for doing this.

They’re professionally managed, so you don’t have to worry about picking individual stocks or managing your own portfolio; the fund manager does all that work for you.

Plus, there’s often greater diversification within mutual funds than with index funds because they invest in multiple sectors and industries.

This means if one sector takes a dip, it won’t affect your entire portfolio as much since other areas may still be performing well.

You get the benefit of spreading out risk without having to put in too much effort, which is pretty sweet!

Professional Management

When it comes to mutual funds, one of the biggest pros is that they are professionally managed. This means you won’t have to spend hours researching and picking individual stocks; instead, a trained fund manager will handle all these decisions for you.

You can relax knowing that an experienced expert is actively managing your investments and making sure they’re on track with your goals. Plus, since they’ll be regularly monitoring performance, you don’t have to worry about missing out on any potential opportunities or not recognizing risks in time—the fund manager’s got your back!

pros and cons of index funds

Moving on to index funds, they have their own set of pros and cons.

On the plus side, these investments are relatively low-cost compared with mutual funds; you can get into an index fund for a fraction of what it might cost to buy shares in a mutual fund. They also boast higher returns than most actively managed funds due to lower management costs and fees. Additionally, index funds generally track stock market indexes, so there’s less need for research or monitoring your portfolio as often.

On the downside, though index funds may offer consistent performance over time, that same consistency means investors who want more growth potential won’t find it here. Indexes will always contain stocks with good performance records but don’t necessarily include up-and-coming companies, which could drive larger returns if chosen correctly by active managers. And since these investments tend to be passive rather than actively managed, they’re not likely to deliver quick profits when markets take off either.

All things considered, index funds come with both rewards and risks, just like any other type of investment. Mutual Funds Versus Index Funds.

Fees and Expenses

When it comes to investing, the old saying ‘you get what you pay for’ holds true. Investment fees and expenses can be like a hidden tax on your returns, eating away at profits over time.

When comparing mutual funds with index funds, these costs are often one of the main differences. Mutual funds typically have higher operating costs than an index fund because they require professional management from investment advisors who actively choose stocks and bonds for the portfolio. Mutual funds may also charge sales commissions (loads) when buying and selling shares and annual maintenance expenses, which are all passed onto investors through higher expense ratios.

Index funds, however, don’t need active managers since they simply track a benchmark index, such as the S&P 500; therefore, there is no commission or extra cost involved when trading them. That said, while it may seem that index funds are always cheaper than mutual funds due to their low-cost structure, not all index funds offer the same value; some might come with additional charges depending on the company managing them.

Risk Considerations

I think portfolio diversification is an important risk consideration when comparing mutual funds to index funds.

Having a variety of investments in your portfolio can help to minimize the impact of market volatility.

Another risk consideration is understanding your investment horizon and how that might affect the types of investments you choose.

Portfolio Diversification

If you’re trying to reduce risk in your investments, portfolio diversification is a great place to start!

By diversifying your holdings across different types of assets and asset classes, like stocks and bonds, or mutual funds and index funds, you can help protect yourself against market volatility.

Plus, it’s easier than ever to build an ideal mix of investments with the wide range of options out there, so go ahead and spread those bets around for a smart approach to investing!

Market Volatility

Market volatility is an unavoidable reality when it comes to investing, and understanding how your investments may behave in different market conditions can help you make more informed decisions.

It’s not just about the upside potential; being aware of the risks that come with any investment can save you from major losses down the line.

Knowing what triggers changes in pricing or liquidity, for instance, might be crucial if you need to quickly adjust your portfolio.

That’s why having a good grasp on these concepts is key to succeeding as an investor!

Investment Horizons

When it comes to investing, having a good understanding of investment horizons is essential.

This means being aware of how long you plan on holding onto an asset before selling it or taking profits from it.

Investment horizons are usually determined by your personal goals and risk tolerance; for example, if you want to quickly take advantage of short-term market trends, a shorter horizon would be more suitable than if you’re looking for a longer-term return.

Knowing the length of time that works best for you can help ensure that your investments meet your expectations in terms of both performance and risk management.

Choosing Between Mutual Funds and Index Funds

When it comes to investing in the stock market, there are two main options: mutual funds and index funds.

Mutual funds allow you to invest in a basket of stocks chosen by an experienced portfolio manager who has insight into which companies have potential for growth.

On the other hand, index funds track major indexes such as the S&P 500 or Nasdaq 100 and take advantage of the lower costs associated with tracking these large markets.

Ultimately, your decision should depend on your personal goals when investing.

If you’re looking for higher returns over time but don’t mind taking more risks, then mutual funds may be right for you.

However, if you want to buy shares that match broader markets without incurring additional investment risk, then index funds might be more suitable for your needs.

Whichever route you choose, make sure to do plenty of research beforehand so that you know exactly what kind of investments you’re getting into.

Frequently Asked Questions

What Are The Tax Implications Of Investing In Mutual Funds Or Index Funds?

Investing in any kind of fund can have tax implications, and so it’s important to understand what these are before you make a decision about which one is right for you.

When investing in mutual funds or index funds, there may be some additional taxes that need to be paid, depending on the type of investment made. For example, capital gains from investments in mutual funds will generally be taxed at your marginal rate, while dividends from index funds may be subject to different rates.

Additionally, certain types of transactions with either fund could result in other taxes, such as sales tax or transaction fees.

It’s always best to consult with a qualified professional when making decisions about your investments so that you know exactly what taxes might apply.

Can I invest in both mutual funds and index funds?

They say two heads are better than one, and the same applies to investing.

If you’re wondering if you can invest in both mutual funds and index funds, the answer is yes!

You don’t have to pick between them; instead, diversifying your portfolio with a combination of investments can be beneficial.

Mutual funds offer investors access to professionally managed portfolios, while index funds track specific market indices, so they each provide different benefits.

Both options present their own set of advantages and disadvantages that should be explored before making any decisions, but it’s possible to benefit from either or both approaches when constructing an investment strategy.

How Do I Research Mutual Funds or Index Funds Before Investing?

Figuring out which mutual fund or index fund to invest in can be a daunting task. But with some research and self-education, finding the right investment for you is easier than it seems.

Start by looking into different funds’ past performances, fees, risk levels, and other factors that could affect your decision. Then look at what fits within your financial goals—do you want long-term growth? Short-term gains? A combination of both? You’ll also need to find out if the fund has any restrictions on how much money you can deposit or withdraw from it.

Finally, consider talking to an advisor about which type of fund might best suit your needs. With careful consideration and research, investing in either a mutual fund or index fund will become simple!

What Is The Minimum Amount I Need To Start Investing In Mutual Funds Or Index Funds?

If you’re thinking of investing in mutual funds or index funds, the first thing to know is how much money you’ll need to get started.

Generally speaking, there isn’t a set minimum amount that needs to be invested; it really depends on which type of fund you choose and where you decide to invest.

Most brokerages will have different requirements for their mutual funds and index funds, so make sure to do your research before committing any money.

Are there different types of mutual funds or index funds?

Investing in mutual funds or index funds can be intimidating for beginners, so it’s important to know what types of investments you’re getting into.

Yes, there are different types of mutual funds and index funds available.

Mutual funds typically come with active management, where a fund manager is responsible for buying and selling securities based on their expertise.

Index funds, meanwhile, are passive investments that track an underlying market index, like the S&P 500.

Knowing the difference between these two helps investors make informed decisions about how they want to invest their money.

Conclusion

Investing in mutual funds and index funds can be a great way to save for the future. With careful research, you can find an investment that works best for your goals and risk tolerance.

Just remember, regardless of which type of fund you choose, it’s important to stay informed on how they perform over time. As with any financial decision, take your time, do your homework, and explore all available options before making a commitment.

By doing so, you’ll ensure that you are investing wisely in order to reach your desired outcome, whether it’s long-term security or short-term gains.

Leave a Reply