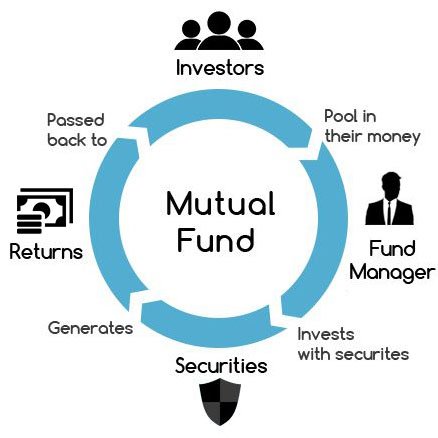

Mutual Funds to Invest in 2023 Top Picks for Growth, Value, Income and Sector Funds Investing in mutual funds is a fantastic way for investors to expand their portfolio without too much risk. The year 2020 was tumultuous for financial markets, with stock prices fluctuating wildly, making most of us anxious about investing. However, despite these challenges, mutual funds offered stability in market volatility. Investors are wondering, which mutual funds should they consider in 2021? Below are the top mutual funds investors should consider investing in. Mutual Funds to Invest

Growth Funds

Growth funds are mutual funds that focus on investing in growth stocks. These funds are suitable for investors with a long-term investment horizon, willing to take on more risk for higher returns.

-

American Funds New Perspective Fund (ANWPX): This mutual fund invests in multinational companies in the United States and around the world. In 2020, the fund had an impressive return of 38.45%, beating its benchmark, the MSCI ACWI Growth Index. This mutual fund is an excellent choice for investors interested in taking a global approach to investing. Mutual Funds to Invest. read more

-

Fidelity Growth Company Fund (FDGRX): This mutual fund invests in companies with high growth potential, providing investors with high returns. It has an excellent track record of outperforming the S&P 500 Index. In 2020, its return was 41.16%.

Value Funds

Value funds are mutual funds that purchase undervalued stocks trading at a lower price than their actual worth. These funds are suitable for investors looking for a lower-risk investment strategy.

-

Dodge & Cox Stock Fund (DODGX): This mutual fund’s investment strategy is centered around value investing, where it invests in undervalued stocks. It has consistently outperformed its benchmark, the S&P 500 Index, over the long term. Mutual Funds to Invest

-

Vanguard Windsor II Fund (VWNFX): This mutual fund invests in companies that have fallen out of favor with the market. It has an impressive track record with an average annual return of 11.61%, beating the S&P 500 Index.

Income Funds

Income funds are mutual funds that invest in fixed-income securities that provide investors with regular income returns. Investors looking for a reliable income stream should consider this type of mutual fund.

-

Fidelity Strategic Income Fund (FSICX): This mutual fund invests in a wide range of fixed income securities. It has an impressive track record of providing a higher yield than its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index. Mutual Funds to Invest

-

T. Rowe Price Dividend Growth Fund (PRDGX): This mutual fund invests in companies with a strong dividend yield. It is an excellent choice for investors looking for a reliable income stream.

Sector Funds

Sector funds are mutual funds that focus on specific sectors, such as technology, healthcare, and energy. These funds are suitable for investors who have a keen interest in a particular industry.

-

Fidelity Select Semiconductors Portfolio Fund (FSELX): This mutual fund invests in companies involved in the production and distribution of semiconductors. In 2020, it had an impressive return of 99.04%. Mutual Funds to Invest

-

Vanguard Health Care Fund (VGHCX): This mutual fund invests in companies in the healthcare sector worldwide. It has consistently outperformed its benchmark, and in 2020, its return was 20.22%.

Investors should consider investing in mutual funds as part of their investment strategy. Mutual funds provide diversification, professional management, and are suitable for investors with any investment horizon. Consider the above mutual funds in your investment portfolio. Mutual Funds to Invest

Investors should also be aware of the mutual fund’s expenses, as the expenses can eat away their investment returns. Research the mutual fund’s past performance, track record and consult with reputable financial advisors before making any investment decisions. Investors should also understand that past performance does not guarantee future success.

Leave a Reply