INVESTING STRATEGIES Tax Loss Harvesting Investing can be intimidating for many, but it doesn’t have to be. Educating yourself on the different strategies available is a great place to start.

Tax loss harvesting is one strategy that can help investors make more informed decisions and maximize their investments. Tax loss harvesting involves strategically selling securities at a loss to reduce tax liabilities when filing taxes. INVESTING STRATEGIES Tax Loss Harvesting.

This process helps lower your taxable income while also providing potential capital gains. Understanding how this strategy works is essential to take advantage of it. I’ll explain what you need to know in this article!

What is tax loss harvesting?

Tax loss harvesting is a powerful strategy for tax-efficient investing. It involves selling investments that have lost value to offset capital gains from other taxable investments and provide an overall reduction in taxes owed on the investor’s portfolio. INVESTING STRATEGIES Tax Loss Harvesting.

This is possible by harvesting losses from one security, such as stocks or mutual funds, to counteract gains made in another investment within the same asset class. By utilizing this strategy, investors can minimize their exposure to taxation on their hard-earned profits while still benefiting from them through reinvestment into more profitable positions.

Using Tax Losses Harvesting effectively requires careful consideration of how different securities are taxed differently at various points throughout the year, including when they were purchased, held, and sold, as well as potential wash sale rules depending on the country’s regulations.

Additionally, it must be considered if any special provisions related to your specific situation could affect your ability to take advantage of this type of strategy. With proper planning and execution of a tax loss harvesting program, however, investors can enjoy significant savings on their total annual tax burden without sacrificing long-term growth potential.

What are the benefits of tax loss harvesting?

Tax-loss harvesting is an effective strategy for investors looking to increase their after-tax returns. By strategically realizing capital losses, investors can lower their income tax bill by offsetting taxable gains from other investments, salary, and wages. This provides an excellent opportunity to reduce your overall tax burden while still enjoying the potential to generate long-term wealth.

The benefits of using this technique as part of a comprehensive investment plan are explicit.

* Tax advantage: Investors may be able to minimize taxes on current portfolio gains by ‘harvesting’ unrealized losses in other areas, reducing their total liability. INVESTING STRATEGIES Tax Loss Harvesting. read more

* Increased return on investment: Taking advantage of tax loss harvesting allows you to maximize your return on investment (ROI) by deferring taxes until the future when it makes more financial sense. INVESTING STRATEGIES Tax Loss Harvesting.

* Capital Gains Deferral: Losses realized through tax harvesting allow savvy investors to delay taxable events that would otherwise trigger immediate capital gains taxation.

Investors who take the time to understand how tax loss harvesting works will find many advantages to this valuable tool for managing a portfolio efficiently and effectively. With careful planning, investors can ensure a balanced approach that maximizes financial gain and minimizes their overall personal tax burden. INVESTING STRATEGIES Tax Loss Harvesting.

What are the risks of tax loss harvesting?

Tax compliance is an important consideration when engaging in tax loss harvesting strategies, as it can be challenging to keep track of the implications of the trades made.

When selling an investment at a loss, it’s essential to consider any potential capital gains implications that may arise in the future.

Lastly, market volatility can pose a risk when engaging in tax loss harvesting, as the value of the investments can shift drastically and unexpectedly.

Tax Compliance

Tax compliance is crucial for any investor looking to utilize the benefits of tax loss harvesting.

As an investment strategist, I firmly advise that you comprehend your legal duties regarding taxes and adhere to the limits set by the law. INVESTING STRATEGIES Tax Loss Harvesting.

Tax avoidance can be beneficial in some cases, but it’s important not to overstep into foul territory when trying to reduce capital gains or other forms of taxation.

As such, maintaining records, staying on top of changes in legislation, and consulting with professionals are all essential steps if you want to safely take advantage of the opportunities available through tax loss harvesting.

Being aware and educated about how taxes work is crucial if you’re serious about investing.

Capital Gains Implications

As an investment strategist, it’s essential to understand the capital gains implications of any tax-efficient strategies you might be considering.

Tax planning strategies that involve harvesting losses may affect how much money you owe in taxes from your other investments and need to be considered when determining whether a particular process is suitable for your situation. INVESTING STRATEGIES Tax Loss Harvesting.

It’s also essential to consider potential restrictions on the number of losses that can be used each year and the ability to carry forward losses if needed.

All these factors are key when assessing the overall risk associated with utilizing tax loss harvesting. INVESTING STRATEGIES Tax Loss Harvesting.

Market Volatility

When considering the risks of tax loss harvesting, it’s essential to factor in the potential impact that market volatility may have on your strategy. INVESTING STRATEGIES Tax Loss Harvesting.

A risk management approach is vital to ensure you take only a slight risk when utilizing this strategy.

Additionally, portfolio diversification can also help, as it reduces overall exposure and protects against unexpected market downturns.

Understanding how these elements interact will be critical for making sound investment decisions.

How do I start tax loss harvesting?

Tax loss harvesting is a powerful investing strategy that can help significantly reduce your tax liabilities. According to Forbes, it has been estimated that nearly half of all Americans need to take advantage of this vital tool to reduce their taxes each year. INVESTING STRATEGIES Tax Loss Harvesting.

As an investment strategist, I highly recommend tax loss harvesting as part of any financial plan. The key to successful tax loss harvesting is careful strategy selection and precise timing in the markets. The goal of the process is to identify investments with losses and replace them while realizing gains elsewhere to offset those losses on your tax return. INVESTING STRATEGIES Tax Loss Harvesting.

Your ability to identify these opportunities requires attention to market trends and understanding how different strategies may be impacted by external factors such as inflation or interest rates. Once determined, taking advantage of these opportunities during specific periods throughout the year can maximize the benefits of this powerful tool.

To ensure success, ensure you are aware of relevant deadlines and consult with professional advisors when needed to gain insights into optimal strategies for successfully utilizing this technique. INVESTING STRATEGIES Tax Loss Harvesting.

What types of investments are best suited for tax loss harvesting?

Mutual funds are perfect for tax-loss harvesting as they provide access to a wide range of assets and can be bought and sold quickly. INVESTING STRATEGIES Tax Loss Harvesting.

ETFs are another great option, as they can be used to diversify a portfolio and are easy to trade.

Stocks are also an excellent choice for tax-loss harvesting, allowing investors to target specific companies and take advantage of market dips.

Mutual Funds

Regarding tax-loss harvesting, mutual funds are an excellent option for investors. They offer the potential for tax-advantaged returns and provide access to diversified portfolios, which can help reduce overall costs by providing exposure to multiple asset classes.

Mutual funds also minimize the trading costs associated with constantly buying and selling individual stocks or ETFs, making them an efficient tool in a long-term investment strategy focused on reducing taxes while achieving desirable returns.

Investing in mutual funds is one of the most effective strategies for building wealth through wise investing and taking advantage of available tax breaks.

ETFs

For those looking to take advantage of tax-loss harvesting, exchange-traded funds (ETFs) can be a great option.

ETFs offer many of the same benefits as mutual funds in terms of diversification and cost basis; however, they often have lower management fees than their mutual fund counterparts.

Furthermore, because ETFs trade like stocks, investors may benefit from more active trading opportunities, which could provide additional tax-advantaged returns over time.

In short, ETFs are an attractive option for investors who want to maximize their potential tax savings while still building wealth through wise investing. INVESTING STRATEGIES Tax Loss Harvesting.

Stocks

Stocks can also be a practical choice for tax loss harvesting due to their ability to provide short-term capital gains and losses. This enables investors to take advantage of the tax-advantaged benefits associated with diversification strategies while providing potential upside in a portfolio.

Trading stocks is relatively easy and provides more active trading opportunities than many other types of investments, allowing investors to increase returns over time without paying higher fees.

Ultimately, stocks are another excellent option for those looking to maximize their potential tax savings through intelligent investing decisions. INVESTING STRATEGIES Tax Loss Harvesting.

What are the tax implications of tax loss harvesting?

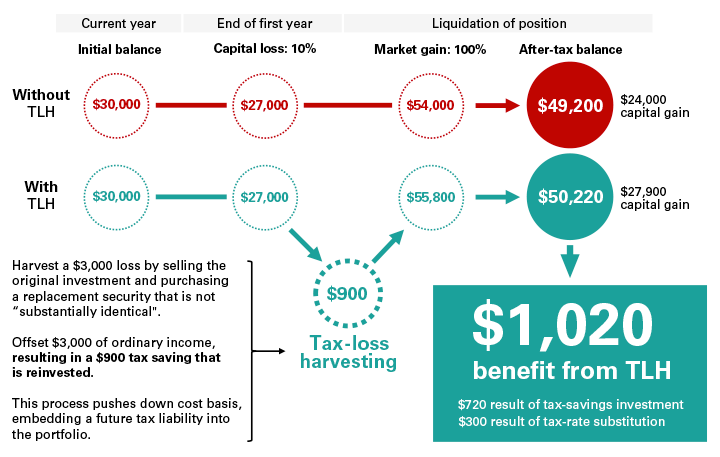

Tax loss harvesting is an excellent way for investors to optimize their deductions while potentially reducing the amount of taxes they owe. By strategically selling certain investments at a loss and reinvesting the proceeds in similar assets, investors can offset capital gains or even reduce taxable income altogether.

When it comes to which types of investments are best suited for tax loss harvesting, look no further than stocks and mutual funds that have decreased in value since you purchased them—these are ideal candidates. Additionally, exchange-traded funds (ETFs) offer more diversification and higher liquidity than individual stocks. Ultimately, when considering investments suitable for tax loss harvesting, focus on securities with a low-cost basis and a high potential for losses.

Investors must also take into account the tax implications of using this strategy. As long as realized losses exceed realized gains during any given year, an investor could see some immediate short-term benefit from these transactions; however, if unrealized losses remain after one calendar year has passed, then all remaining deferred losses will become invalidated and cannot be used towards future deductions.

Furthermore, if the same security is reacquired within 30 days of the sale, then the transaction would not qualify for tax loss harvesting purposes due to the washing sale rules set forth by the IRS. As such, careful consideration should always be given before engaging in any tax-loss harvesting activity. INVESTING STRATEGIES Tax Loss Harvesting.

What other strategies can I use to reduce my tax liability?

Tax loss harvesting is essential for any investor looking to reduce their tax liabilities. But that’s not the only way! You can use countless other strategies to decrease your taxes, ultimately leading to more money in your pocket. INVESTING STRATEGIES Tax Loss Harvesting.

For starters, consider investing in tax-deferred investments and tax-exempt bonds. Tax-deferred investments allow you to delay paying taxes on profits until a later date, usually when you’re retired or at least no longer earning income from your investments. And with tax-exempt bonds, interest earned from them isn’t taxable either!

Here’s how else you can lower your taxes:

* Make charitable donations: By donating part of what you earn each year, you may significantly reduce your overall taxable income. This reduces your amount owed and might even result in a deduction on next year’s return if done correctly.

* Maximize Retirement Account Contributions: Contributing as much as possible into retirement accounts like 401ks and IRAs allows investors to benefit from tax deductions while they save for retirement.

* Take Advantage of Other Investment Opportunities: Investing in stocks, mutual funds, real estate trusts, foreign exchange trading markets, etc., all have opportunities available that could minimize an investor’s total taxation due throughout an entire financial year.

As an investment strategist, I recommend researching these options further and exploring which ones fit best within one’s portfolio goals. Utilizing multiple methods together will ensure optimal success in reducing both short-term and long-term taxation costs associated with various types of investments made over time.

What Should I Keep in Mind When Harvesting Tax Losses?

Tax loss harvesting is a strategy investors use to reduce their tax liability. When done correctly, it can help you save money on taxes and improve your asset allocation.

It’s essential to keep a few considerations in mind when practicing this method of investing. First and foremost, you must be aware of the cost basis of each security included in your portfolio. This means that any capital losses realized from investments will only be deductible up to the amount paid for them—no more than that.

Secondly, you should also ensure that your asset allocation remains balanced throughout the process; too much focus on one area could lead to undesirable outcomes. This means carefully monitoring which assets are being sold off and ensuring there isn’t an excessive concentration of positions in one particular sector or industry.

Tax loss harvesting requires research and sound knowledge about how markets work before deciding whether this option is appropriate for your portfolio. The most successful investors understand the importance of staying informed and taking advantage of every helpful tool available to maximize returns while minimizing their taxable liabilities at all times.

Conclusion

Tax-loss harvesting is a powerful strategy that savvy investors should consider.

It can be like a shield, protecting your portfolio from the taxman’s grasp and allowing you to keep more of what you earn.

However, it is with risk and must be approached with caution.

Do your research and consult an investment strategist if needed before jumping in headfirst.

With proper planning and execution, tax loss harvesting can help ensure long-term success for investors looking to maximize their returns while minimizing their taxes.