Do you want to secure your finances for the future? Are you looking for a reliable and safe way to invest your money? If so, then a group deferred annuity could be the right choice for you.

This type of annuity allows individuals or groups to set aside funds over time without having to worry about market volatility. In this article, we’ll discuss what a group deferred annuity is, how it works, and why it’s an attractive option for those seeking long-term financial security.

A group deferred annuity is a contract between an investor (or investors) and an insurance company that guarantees income at some point in the future. It’s similar to other types of investments in that there are risks associated with them; however, these tend to be relatively low when compared to stocks or mutual funds.

With this type of investment, you can choose when you receive your payments—either now or later—and defer taxes until then as well.

By putting money into a group deferred annuity, you can rest easy knowing that your money will be there when you need it most in retirement. You also won’t have to worry about losing any principal if markets decline since the value of the investment is locked in at purchase. In the end, a group deferred annuity is your best bet for a reliable way to save for the future while minimizing risk today.

Overview of Deferred Annuities

Approximately 70% of Americans are not saving enough for retirement, according to a recent survey by the U.S. Department of Labor. A deferred annuity can help bridge that gap and provide financial security in one’s senior years. In this article, we will explore what an annuity is, how it works, its benefits, and the types of options available, so you can make informed decisions about your future.

An annuity is a type of investment that gives the investor regular payments in exchange for a one-time premium payment or payments made over time. Deferred annuities offer tax-deferred growth opportunities on assets within the account until withdrawals begin at some point later in life, typically during retirement age when taxes may be lower than at earlier stages in one’s career.

In addition to potential growth opportunities, there are also other benefits associated with using a deferred annuity, such as a guaranteed income stream upon reaching a certain age, as well as allowing access to funds without penalty prior to retirement should any emergency arise. It’s important to understand these features before deciding whether an annuity fits into your overall financial plan.

Now let us move onto exploring the various types of deferred annuities offered.

Types of Deferred Annuities

Now that we have an overview of deferred annuities, it is important to focus on the different types available. There are four main categories of deferred annuities: immediate, fixed, indexed, and variable.

Immediate Annuities: Immediate annuities provide a stream of income payments as soon as you purchase them. The amount paid will depend on your age at purchase and interest rates, but these payments typically increase over time due to inflation adjustments or cost-of-living increases.

Fixed Annuities: Fixed annuities guarantee the same rate for a set period of time. These can be used for short-term savings goals (such as retirement) and long-term investments because they offer security from market volatility.

Indexed Annuities: Indexed annuities track an underlying stock index such as the S&P 500® and pay out benefits based on how well the index performs during its term. They also come with some guarantees in case there is a downturn in the market, so you won’t lose all your money.

Variable Annuities: Variable annuities give investors more control over their portfolios by allowing them to choose the type of investment vehicle they want to use (stocks, bonds, mutual funds). This allows them to create a portfolio tailored to their individual needs and risk tolerance levels.

Here are five benefits of investing in deferred annuity products:

Tax Deferral: Taxes are not paid until withdrawals start after retirement.

Flexibility: Investors have multiple options when choosing how much money to put into each account.

Investment Variety: Choose from stocks, bonds, mutual funds, and other asset classes depending on personal preference.

Longevity Protection: The guaranteed lifetime income option protects against the longevity risk.

Accessible Funds: Withdrawals allowed without paying surrender charges if needed.

Deferred annuitization provides many advantages for savers looking for guaranteed income streams throughout their lifetimes. Understanding the differences between each type of product can help investors make informed decisions about their future financial plans.

Benefits of Deferred Annuities

Deferred annuities offer a number of benefits that can help you achieve your long-term financial goals. The most important benefit is the potential for long-term growth in an account that grows tax-deferred. This means that all of the gains on your investment accumulate without being taxed each year, allowing your money to grow faster than it would if taxes were taken out annually. Additionally, deferred annuities guarantee a steady income stream during retirement and provide financial security by protecting you from market downturns or unexpected expenses.

One of the best things about deferred annuities is how flexible they are when it comes to withdrawing money and making plans for your estate. You can choose how much income you want to receive, when you want to start receiving payments, and even designate beneficiaries who will inherit any remaining funds after your death. Plus, these investments are often available with rider options such as guaranteed minimum withdrawals or optional survivor benefits like joint life insurance policies, which ensure continued coverage until both policyholders have passed away.

Overall, deferred annuities offer many advantages that make them attractive investments for those seeking long-term growth and financial stability in retirement. With careful planning and a close look at the different features offered by different companies, investors can find the right product for their needs and rest easy knowing they have a steady source of income for their golden years. With this understanding of the benefits provided by deferred annuities, we now turn our attention to looking at some of their drawbacks and disadvantages.

Advantages and disadvantages

Now that we have discussed the benefits of deferred annuities, let’s look at their advantages and disadvantages. Deferred annuities offer a number of pros and cons, including:

Advantages

Tax-deferred growth: Contributions to an annuity are not taxed until withdrawals begin. This means that interest earned on those contributions is allowed to grow faster by avoiding taxes.

Flexible withdrawal options: Depending on the type of annuity purchased, there may be flexible payment options available for taking distributions from the contract.

Death benefit protection: an annuity can provide financial security for beneficiaries in the event of their death. Some contracts also include living benefit riders, which allow access to funds while still alive if certain conditions are met.

Disadvantages

High costs: Annuities typically come with high sales fees and administrative costs associated with them, so it’s important to consider these when deciding whether or not to purchase an annuity.

Limited Access to Money: If you take money out of an annuity before you reach retirement age, you may have to pay surrender fees and income tax penalties, depending on how much you took out early. Also, some types of annuities limit how much you can withdraw each year after retirement age has been reached without penalty.

Reduction in spending power due to inflation: annuities do not normally keep up with inflation, so they may not be able to cover all expenses during the retirement years.

Overall, buying a deferred annuity comes with both risks and benefits. Knowing both the possible costs and benefits can help you make better decisions about your financial planning goals. With this knowledge in hand, let’s move on to considering the tax implications of deferred annuities when making long-term financial plans.

Tax Implications

A deferred annuity is a tax-deferred investment account that provides several tax advantages. Contributions to the annuity are usually tax-deductible, meaning investors can lower their overall taxable income and defer taxes on any growth or earnings until withdrawal. This allows them to take advantage of compounding interest over time and grow their money more efficiently than other investments with less of a tax liability.

It’s important to note that withdrawals from a deferred annuity may be subject to taxation depending on when they’re taken out, as well as how much contribution has been made in comparison to gains. Withdrawals before age 59 1/2 will typically incur an additional 10% penalty fee in addition to regular income taxes due on the withdrawn amount.

Investors should consider all these factors carefully before investing in a deferred annuity so they understand the full scope of its potential financial benefits and drawbacks. Transitioning into the next section, understanding different investment strategies for using a deferred annuity can help investors make informed decisions about whether it’s right for them or not.

Investment Strategies

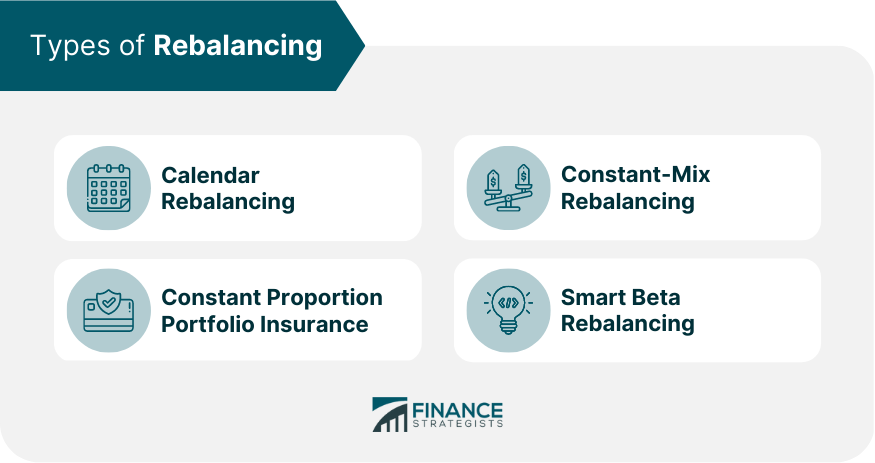

Now that we’ve discussed the tax implications of deferred annuities, let’s look at investment strategies. When investing in a deferred annuity, it is important to consider asset allocation and diversification strategies, as well as portfolio rebalancing and tax-loss harvesting.

The three main components of successful investment strategies are:

1. Asset Allocation: This involves determining how much money should be allocated to various assets, such as stocks, bonds, mutual funds, real estate, etc.

2. Diversification Strategies: Investing in different types of investments can help reduce risk by spreading out your capital across multiple markets or sectors.

3. Portfolio Rebalancing: As market conditions change over time, investors need to periodically adjust their portfolios so they remain balanced with respect to their overall goals and objectives.

Tax-loss Harvesting allows investors to take advantage of losses on certain investments in order to offset gains elsewhere within their portfolio, thus reducing their overall taxable income for the year.

All these factors come into play when considering an appropriate investment strategy for a deferred annuity. It is essential to have an understanding of all these elements before making any decisions about investing in a deferred annuity product. With this knowledge, you will be better equipped to make informed decisions regarding your financial future and maximize your returns from investing in a deferred annuity product.

Having outlined the key aspects of investment strategies for deferred annuities, let’s turn our attention towards performance considerations.

Performance Considerations

Performance considerations can be tricky business when investing in group deferred annuities. On one hand, the potential rate of return is attractive, and there are many risk management strategies to consider with portfolio diversification. However, on the other hand, volatility analysis must be taken into account for any investment decision.

It’s easy to get caught up in the idea that higher rates of return equate to more money in your pocket; however, this isn’t always true. Taking risks without proper research or understanding could have devastating effects on returns over time. It’s important to ensure you understand all aspects of an investment before taking it on, no matter how great it might initially look!

Investing in a group deferred annuity requires careful thought and consideration from many different angles. Research should include looking at historical performance data as well as future projections based on current market conditions. Additionally, fees and expenses associated with the product need to be factored into your calculations when determining if such an investment is right for you. Ultimately, by doing your due diligence upfront and carefully considering all elements involved in such investments, you will be better able to make a sound financial decision regarding whether or not to invest in a group deferred annuity. With these steps complete, you can then determine whether now is the right time for you to take advantage of this type of opportunity or wait until later when circumstances may be more favorable.

Fees and Expenses

Moving on from performance considerations, fees and expenses play an important role in any annuity. All annuities have some kind of fee or expense associated with them, including deferred annuities. These fees can be broken down into two categories: those that are charged when the policy is issued and those that are paid while it’s held.

When a deferred annuity is first purchased, certain types of fees might be taken out at the time of purchase. This includes underwriting fees, administrative costs, mortality and expense charges, and premium taxes. In addition to these upfront costs, there may also be ongoing expenses, such as annual service charges and management fees for actively managed investments within the annuity.

Deferred annuities also typically include investment-related expenses known as “expense ratios,” which cover things like trading commissions, custodial services, 12b-1 marketing fees, and other costs directly related to managing the underlying investments in the annuity contract. Expense ratios vary widely depending on the type of investment being offered by the insurer, but they generally range between 0.2% and 1%. It’s important to understand all of these potential costs before committing money to a deferred annuity so you know what kind of return you can expect after accounting for all applicable fees and expenses.

Surrender charges could also apply if you decide to take money out early from your deferred annuity; we’ll look at this issue next.

Surrender Charges

Surrender charges, also known as exit fees or liquidity penalties, are applicable when an individual withdraws funds from their group deferred annuity. Early withdrawal can incur a penalty, the amount of which depends on the terms of the contract and how long ago it was purchased. Generally speaking, surrender charges decrease over time until they no longer apply; however, this varies by provider.

The purpose of these charges is to discourage premature withdrawals—especially those designed for short-term gains—that would otherwise adversely impact both the company providing the annuity and its customers. In other words, the earlier you make a withdrawal from your annuity, the higher penalty you will pay for doing so. It’s important to understand these details before entering into any agreement with a provider.

These surrender charges should be taken into consideration when deciding whether or not to invest in a group deferred annuity plan. As with all financial decisions, understanding all the risks associated with investing in them is key to making an educated decision about what kind of product best suits one’s needs. Now we’ll discuss qualified vs. non-qualified plans and their respective advantages and disadvantages.

Qualified vs. non-qualified plans

Stepping away from the complexities of surrender charges, let’s explore the difference between qualified and non-qualified plans. These two types of annuities can both provide a steady stream of income during retirement while offering tax advantages. However, they differ in how they are regulated and taxed by the government.

Qualified plans such as 401(k)s and IRAs are typically sponsored by employers or opened individually and offer tax-advantaged benefits for those looking to save for retirement. Contributions made to these accounts are not immediately taxable and grow tax-deferred until withdrawn upon reaching retirement age.

Additionally, contributions may be deducted from one’s taxes when filing, making them attractive options for those hoping to maximize their savings with minimal current taxation.

Non-qualified plans, on the other hand, do not have the same levels of regulatory oversight or federal income tax benefits associated with them. Contributions made to this type of account are subject to immediate taxation, and any gains earned within it will also be taxed at regular income rates, unlike those made to federally qualified plans, which offer more favorable long-term capital gain treatment.

That being said, non-qualifying contracts still offer many valuable features, including death benefit protection for beneficiaries that differs from traditional life insurance policies.

Here is a list summarizing some of the unique differences between qualified and non-qualified plans:

Qualified Plans: Tax Advantaged Benefits; Deduction Available When Filing Taxes; Grows Tax Deferred Until Withdrawal Upon Reaching Retirement Age

Non-qualified plans: immediate taxation on contributions; earnings taxed at the regular income rate; death benefit protection

These two types of annuities can provide different forms of security depending on an individual’s financial needs and goals, but understanding each option is critical before making any commitment to either one. Moving forward in our discussion, we’ll take a look at how death benefits play an important role in annuity planning…

Death Benefits

Death benefits are a key feature of deferred annuities. When the contract owner dies, their beneficiary (or beneficiaries) will be entitled to receive survivorship benefits in the form of a death payment.

This is true regardless of how much money has been invested in the annuity or when contributions were made over time. It’s important for contract owners to understand that they can designate who will receive these death payments and update those beneficiary designations as often as needed through their estate planning process.

The death benefit from a deferred annuity may also include additional features such as extended guarantees, which provide extra protection for beneficiaries if the contract owner passes away before reaching retirement age. All of the details about what types of death benefits might be available should be discussed with an insurance professional prior to making any purchases.

By understanding all aspects related to the potential death benefits associated with deferred annuities, it’s easier for individuals to make informed decisions about whether this type of investment product fits within their overall financial goals and objectives. Moving on, we’ll explore contract ownership options and other essential components related to purchasing a deferred annuity.

Contract Ownership Options

When investing in a group deferred annuity, it is important to understand the various ownership options available. One of these options is joint ownership, which allows two or more people to have shared rights over an asset and can be beneficial for couples looking to save together. It also gives each owner equal access to and control over the property. Another common option is transferable ownership, which means that rights are allowed to be transferred from one person to another without any limitations.

Irrevocable ownership is also an option with a group deferred annuity; this type of ownership means that once given, no changes can be made unless both parties agree on them.

Multi-ownership allows multiple owners to have different interests in the same contract at the same time. Lastly, revocable ownership grants one individual full authority over the contract but does not protect them if they pass away unexpectedly.

These five types of ownership provide flexibility when deciding how best to utilize your deferred annuity funds according to your financial needs. Choosing the right contractual arrangement could determine whether you receive maximum benefit from your investment down the line. Knowing everything there is to know about contract ownership will help you make smart choices about your future savings plan.

Group Deferred Annuity Plans

The landscape of financial security is vast and complex. From retirement savings plans to life insurance policies, there’s no shortage of options for individuals who want to plan for their futures. One such option that might be worth considering is a group deferred annuity plan.

Group deferred annuities are an agreement between an individual or a group of individuals and an insurer. In exchange for payments made over time, the insurer promises to provide regular income in retirement when the policy matures. Here are four benefits potential buyers should consider before investing in a group deferred annuity:

1. Guaranteed Income: Group annuities offer guaranteed payments upon maturity, regardless of market conditions.

2. Tax-deferred growth: Withdrawals from a deferred annuity are taxed at ordinary income tax rates instead of capital gains taxes, which can help maximize returns on investments over time.

3. Death Benefits: Some annuity contracts also include death benefits that pay out if the insured passes away prior to receiving any payments from the contract.

4: Performance Potential: Annuity performance depends on how well it’s managed by its issuer, so it helps to select one with a good track record and ratings from independent analysts like Morningstar or S&P Global Ratings.

Investing in a group deferred annuity can be a great way to secure your retirement future, especially if you’re part of a large organization or have access to discounted premiums through employer-sponsored plans. So who should consider putting money into this type of investment? Employers looking for ways to reward employees after years of service, retirees hoping to supplement pensions or Social Security, anyone interested in creating generational wealth, and those seeking a steady stream of income during their golden years may all benefit from this type of product, which offers long-term stability and peace of mind.

Who Should Consider a Group Deferred Annuity?

Group deferred annuities are a great retirement savings option for many people. They offer employers the ability to make contributions on behalf of their employees, with tax-deferred benefits that can be tailored to meet individual retirement needs. Employees benefit from having access to a group annuity contract and all the advantages it offers, such as tax-deferred savings and guaranteed lifetime income payments.

It’s important to understand who should consider taking advantage of this type of retirement plan before making any decisions. Employers should look into whether they can make employer contributions or other special arrangements that may suit their workforce better than traditional options like 401(k) plans. Additionally, those individuals looking for more flexibility in how they save for retirement may want to explore setting up a group deferred annuity through their employer.

Overall, it is essential for both employers and employees to research the details of each group deferred annuity plan prior to signing up so that everyone involved understands exactly what rights and obligations come along with the agreement. This will help ensure that participants get the most out of these unique plans and maximize their potential returns over time. With careful consideration given to which plan best fits an individual’s needs, there are numerous opportunities available when it comes to investing in a group deferred annuity.

With this information in mind, let’s look at some key takeaways about group deferred annuities.

Key Takeaways

Group deferred annuities are a great way to save for retirement. They offer numerous benefits, such as tax-deferred growth and the ability to create a steady stream of income in retirement. It’s important to understand the different investment strategies available when considering an annuity so that you can choose one suited to your financial goals.

When you buy an annuity, you should be aware of all the fees that come with it, such as enrollment fees and surrender charges. Annual costs vary depending on the type of annuity chosen and should be factored into any decision about whether or not to invest in one. Additionally, it is essential that any guarantees offered by the issuer be understood before committing funds.

Before making a final decision about purchasing a group deferred annuity, consider how it fits with your current investments and overall retirement plan. Research several providers thoroughly to ensure you select the best possible option for your situation.

Frequently Asked Questions

What Is The Maximum Contribution Limit For A Group Deferred Annuity?

When it comes to investing in annuities, understanding how much you can contribute is key. What’s the maximum contribution limit for a group deferred annuity? To understand this question, we must first look at what a group deferred annuity is and then explore the associated limits.

A group deferred annuity is an investment plan that allows employers to provide their employees with retirement benefits. It has several advantages compared to other types of investments, such as tax deferral on earnings and growth potential. The contributions made to these plans are not taxed until they are withdrawn from the account. Additionally, there are no income restrictions when contributing to a group deferred annuity.

The amount that can be contributed annually depends on the type of employer or organization sponsoring the plan. Most organizations won’t let you give more than $56,000 per year, but some might, depending on the situation. Furthermore, while individuals don’t typically have access to their funds prior to retirement age without penalties, certain exceptions may apply if withdrawals are needed due to financial hardship or another qualifying event.

It’s important to note that every annuity investment carries its own unique set of risks and rewards, so it’s best to consult with your financial advisor before deciding whether or not one is right for you. Understanding the details surrounding maximum contribution limits for group deferred annuities will help ensure you make informed decisions about your finances in order to reach your future goals and dreams more quickly.

Are There Any Penalties for Early Withdrawal From A Group Deferred Annuity?

Are there any penalties for early withdrawal from an annuity? This is a question that many people may have, especially those considering investing in one. It’s important to understand the potential repercussions of withdrawing funds before the maturity date and what options are available.

There are several types of annuities, including group deferred annuities, which come with their own set of rules regarding withdrawals. Here is a list outlining some key points about the potential penalties for making an early withdrawal from such an account:

1. Early withdrawal penalties could be imposed depending on when money is withdrawn.

2. Group deferred annuity penalties could include taxes or other fees that might not apply to traditional investments.

3. Annuity-withdrawal penalties can vary based on the type of plan as well as its terms and conditions, so it’s best to read through all paperwork thoroughly before making any decisions.

When looking at group deferred annuity early withdrawal options, understanding the penalty structure can help you make more informed choices with your finances. As each situation is different, talking to an experienced financial advisor who specializes in these types of accounts can help you understand the specifics of group deferred annuity withdrawal and early annuity withdrawal.

Ultimately, it’s essential to carefully consider all aspects before deciding whether or not this type of investment strategy is right for you and how soon you should access the funds without incurring unnecessary expenses due to the premature liquidation of assets within your portfolio.

What Is The Minimum Age Requirement To Invest In A Group Deferred Annuity?

Investing in an annuity can be a daunting prospect, but it doesn’t have to be! With the right knowledge and preparation, you can make sure that your investment is as safe and secure as possible. Before putting money into any kind of annuity, it’s important to know what the minimum age is for such investments. This article will tell you how old you have to be to invest in a group deferred annuity, so you can make a decision with confidence.

When it comes to annuity investments, there’s no one-size-fits-all solution. Every provider has its own set of rules regarding who can and cannot participate in their plans. When it comes to group deferred annuities, the minimum age requirement typically falls between 18 and 59 years old, depending on the particular company or plan chosen.

While this may seem like a wide range of ages, each plan should provide clear information about their specific eligibility requirements prior to signing up.

It’s important to remember that even if you meet the minimum age limit for investing in a group deferred annuity, additional restrictions may still apply based on individual circumstances. For example, some providers won’t let people join their programs unless they have a certain amount of money or a good credit history.

Additionally, most companies also impose limits on how much money someone can put into an annuity at once—usually somewhere between $1 and $2 million per account holder—which could affect younger applicants more than older ones with larger financial resources available.

No matter what your circumstances are, though, researching potential plans carefully should help you determine whether or not investing in a group deferred annuity is right for you now or down the road. Taking time to compare features like fees, returns policies, and other details will give you peace of mind knowing that you’ve made an informed decision about where your hard-earned savings go.

Are There Any Other Risks Associated With Investing In A Group Deferred Annuity?

Putting money into an annuity can be a great way to save for retirement, but there are other risks involved. When it comes to group deferred annuities, investors should take the time to understand potential risks beyond the minimum age requirement before investing any money. These risks include:

Investment Risk:

Market fluctuations that may affect returns on investment

loss of principal value due to inflation or economic conditions

Annuity Withdrawal:

Early withdrawal penalties and fees from annuity contracts

Tax implications of taking out more than allowed distributions

Annuity Penalties:

Charges for surrendering your contract early

You’ll incur additional costs if you fail to make payments on time or default on your loan agreement.

Before investing in an annuity, you should also carefully look over the terms and conditions of each individual group annuity. It’s important to know these details because they will tell you how much freedom you have when managing your account. It’s also important to think about any extra fees or taxes you might have to pay if you withdraw money early or don’t meet your contractual obligations.

By considering all potential risks associated with investing in a group deferred annuity, one can make an informed decision about whether this type of product is right for them.

Is there a beneficiary option for my group deferred annuity Group Deferred Annuity?

When it comes to investing in a group deferred annuity, one of the most important decisions you can make is whether or not to add a beneficiary. When you name a beneficiary for your annuity, you make sure that your investment and all of its benefits will go to that person after you die. But how do you go about adding a beneficiary?

Many people worry that adding a beneficiary may be a complex process, but this isn’t necessarily true. In fact, many providers allow you to easily add a beneficiary directly from their online platform with just a few clicks. Once you have added them as the annuity beneficiary, they will then receive the remaining balance of your group deferred annuity once you pass away.

You should also know that you don’t have to name someone as the annuity beneficiary on your group deferred annuity policy if you don’t want to. You could consider setting up a trust or assigning power of attorney so that another person can manage the finances when you’re gone.

No matter what option works best for you, it’s essential to take into account who will benefit from your investments when making any decision involving money.

Conclusion

I must emphasize one thing: early withdrawal from this type of annuity comes with hefty penalties. So if you’re tempted to take out money before it’s time, think twice about it! In short, investing in a group deferred annuity is an incredibly safe and rewarding choice for me and everyone else looking for long-term growth potential.

In conclusion, putting money into a group deferred annuity is a great way to make sure you have money in the future. The maximum contribution limit and minimum age requirement are truly impressive—there’s no excuse not to start saving now! On top of that, the option to add a beneficiary adds another layer of protection for my loved ones.

Leave a Reply