Optimizing Annuity Portfolios Asset Allocation Strategies for Investor Profiles When it comes to managing annuity portfolios and optimizing asset allocation, understanding the needs and preferences of different investor profiles is crucial. Conservative investors prioritize capital preservation and income generation, while aggressive investors seek growth and capital appreciation. Customizing asset allocation based on risk tolerance and investment time horizons allows for a personalized approach to annuity portfolio management. In this article, we will explore the strategies and considerations involved in asset allocation for different investor profiles, focusing on annuity portfolio management. By tailoring asset allocation to specific investor profiles, individuals can effectively leverage annuities and other investment vehicles to achieve their financial goals. Annuity Portfolios

Asset Allocation Considerations for Conservative Investors

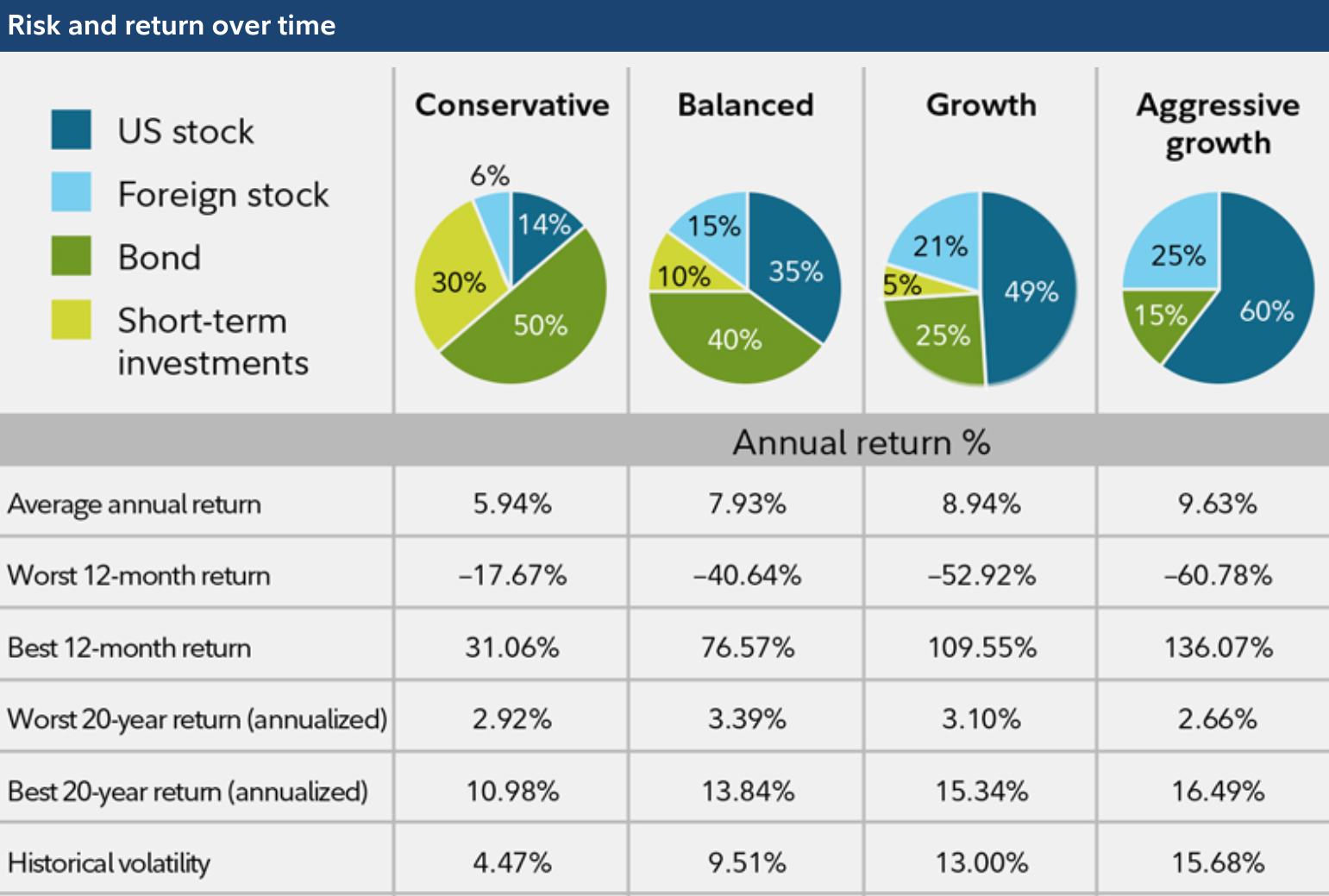

Conservative investors typically have a low tolerance for risk and prioritize capital preservation over significant market fluctuations. Regarding asset allocation, conservative investors aim to generate stable income while minimizing the impact of market volatility. Annuities play a crucial role in conventional asset allocation strategies due to their potential for guaranteed income and capital protection. Annuity Portfolios

One practical approach for conservative investors is to allocate a significant portion of their portfolio to fixed annuities. Fixed annuities offer a predetermined interest rate over a specified period, providing a predictable income stream. By investing in fixed annuities, conservative investors can ensure a steady flow of income and mitigate the risk associated with market fluctuations. read more

Additionally, conservative investors may consider incorporating income riders into their annuity contracts. These riders provide a guaranteed minimum income even if the underlying annuity investment experiences poor performance. Including income riders enhances the income-generation potential of annuities, making them an attractive option for conservative asset allocation.

Asset Allocation Strategies for Aggressive Growth Objectives

Aggressive investors are willing to take on higher levels of risk in pursuit of capital growth and substantial returns. When crafting asset allocation strategies for aggressive growth objectives, it’s important to diversify investments and consider growth-oriented annuity products. Annuity Portfolios

One approach for aggressive investors is to allocate a significant portion of their portfolio to variable annuities. Variable annuities allow investors to allocate their funds among different investment options, such as equity or growth-oriented mutual funds. This flexibility enables aggressive investors to participate in potential market upswings and capture higher returns.

In addition to variable annuities, aggressive investors may consider diversifying their portfolios with other growth-oriented assets, such as equities and real estate investment trusts (REITs). These asset classes have the potential for substantial growth over the long term but also come with higher levels of risk. Aggressive investors can create a well-rounded portfolio that aligns with their growth objectives by combining growth-oriented annuities with other high-risk assets.

Customizing Asset Allocation Based on Risk Tolerance and Time Horizon

Customizing asset allocation based on individual risk tolerance and investment time horizons allows investors to balance risk and reward. Moderate, balanced, or moderately aggressive investors require asset allocation strategies that reflect their risk profiles.

Moderate investors typically have a balanced approach to risk and seek average growth while preserving capital. They may allocate their annuity portfolios to a mix of fixed and variable annuities to balance income generation and potential development.

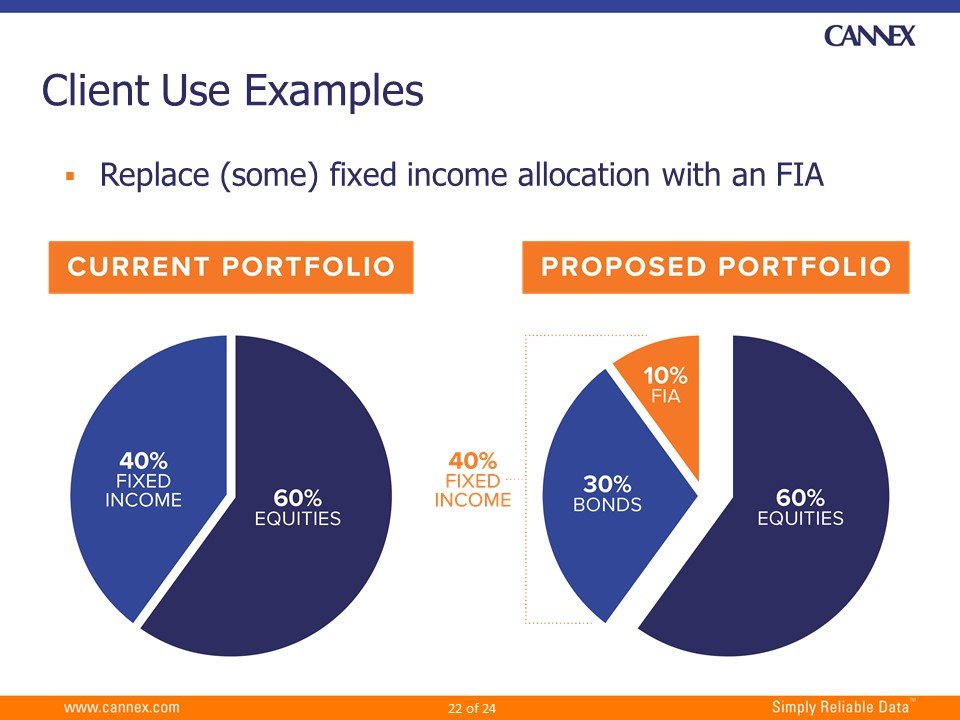

Balanced investors aim to distribute their investments evenly between conservative and growth-oriented assets. They may allocate a portion of their annuity portfolio to fixed annuities for stability and guaranteed income while diversifying with variable and other growth-oriented assets.

Moderate-aggressive investors have a higher tolerance for risk and seek a greater degree of growth. They may allocate a significant portion of their annuity portfolio to variable annuities, equity funds, and other high-risk assets. These investors are willing to accept short-term fluctuations.

To achieve higher long-term returns.

When customizing asset allocation based on investment time horizons, it’s essential to consider annuity maturities or withdrawal periods. Short-term investors with a time horizon of a few years may opt for shorter-term annuities or annuity products with more flexible withdrawal options. This allows them to access their funds when needed without incurring significant penalties.

Long-term investors, such as those planning for retirement or wealth accumulation over several decades, can take advantage of longer-term annuities. These annuities provide the opportunity for sustained growth and higher returns over time. By aligning the duration of annuities with long-term investment goals, investors can benefit from the compounding effect and maximize the growth potential of their annuity portfolios.

It’s important to note that customizing asset allocation is not a one-time process. Investor profiles may evolve, and it’s essential to regularly review and adjust asset allocation strategies accordingly. As risk tolerance and time horizons change, reallocating annuity portfolios becomes necessary to ensure alignment with investors’ evolving objectives.

Seeking professional advice from financial advisors or asset allocation specialists can significantly assist in customizing asset allocation. These experts can provide valuable insights, conduct risk assessments, and recommend suitable annuity products based on investors’ profiles. By leveraging their expertise, investors can navigate the complex landscape of annuity portfolio management and asset allocation more effectively.

In conclusion, annuity portfolio management and asset allocation strategies should be tailored to the specific needs and preferences of different investor profiles. Conservative investors can benefit from fixed annuities and income riders, prioritizing capital preservation and stable income generation.

Aggressive investors, on the other hand, may focus on growth-oriented assets such as variable annuities, equities, and REITs to maximize capital appreciation. Customizing asset allocation based on risk tolerance and investment time horizons allows for a personalized approach that balances risk and reward.

Regular reviews and adjustments to asset allocation strategies are essential to ensuring continued alignment with evolving investor profiles. By considering these strategies and seeking professional advice, investors can optimize their annuity portfolio management and asset allocation to achieve their financial goals.

Leave a Reply