Annuity Formula Derivation. Have you ever wanted to learn how annuity formulas are derived? If so, then this article is for you! Annuities offer an investment option that provides steady streams of income over a period of time. As such, it’s crucial to understand the math behind calculating annuities and their associated payments. In this piece, we’ll look at the steps required for deriving annuity formulas from scratch. Whether you’re new to finance or simply want a refresher course on annuity formula derivation, get ready – because by the end of this article you’ll be able to come up with your own calculations accurately and confidently. So let’s dive in and explore exactly what goes into annuity formula derivation.

Definition

An annuity is an investment that pays a fixed amount of money at regular intervals. It can provide people with a steady income to last throughout their retirement. Understanding the definition and meaning of an annuity is essential for anyone interested in investing or planning for retirement.

The term “annuity” comes from the Latin word “annualis,” which means yearly. In financial terms, an annuity is a contract between two parties: the investor (or buyer) and the insurance company (or issuer). The buyer agrees to pay either a single payment or multiple payments over time to the issuer, who then promises to pay out a predetermined sum on regular intervals as long as certain conditions are met. Generally speaking, these payments are usually made monthly or annually but may vary depending on the type of annuity purchased.

When purchasing an annuity, investors should consider factors such as age, rate of return, fees, inflation risk, liquidity needs, tax treatment, and more. Knowing all this information about an annuity will help buyers make informed decisions so they can enjoy financial security during their retirement years. With that said let’s move onto exploring the history of annuities…

History Of Annuities

Now that the definition of an annuity is understood, it’s important to understand its history. Annuities have a long and varied timeline of origin and evolution.

The first known use of annuities can be traced back to Ancient Rome in 300 BC when Emperor Diocletian established state pensions for soldiers who had served twenty-five years or more. This was the beginning of what we now call the modern pension system.

In 1759, Edward Lloyd created one of America’s first financial institutions – Lloyd’s Insurance Corporation – which began offering life insurance policies with fixed rates as well as annuity contracts. Over time, these early forms of annuities developed into different types of products such as deferred annuities and variable annuities. These two products are still popular today because they offer investors tax advantages and protection against market volatility.

Annuities continue to evolve alongside technology, providing clients with innovative ways to invest their money while also protecting them from risks associated with traditional investments. With this in mind, let’s explore the various types of annuities available today.

Types Of Annuities

Annuities come in a variety of forms, each offering different features and benefits depending on an individual’s financial goals.

The main types of annuities include:

- Variable Annuities – These are long-term investments that offer the potential for growth while providing tax deferment. They allow individuals to invest their money into professionally managed portfolios with varying levels of risk.

- Deferred Annuities – These provide guaranteed income later in life when the policyholder reaches retirement age or another predetermined period of time. It allows individuals to save now and receive payments at a future date.

- Continuous Annuities – This type of annuity is designed to pay out a steady stream of income throughout the duration of one’s life expectancy. The amount can be adjusted based on inflation rates and other factors over time.

- Immediate Annuities – As opposed to deferred annuities, immediate annuities start paying out during the lifetime of the policy holder as soon as they purchase it. The payout depends upon factors such as age, gender, interest rate and initial principal investment amounts.

- Fixed Annuities – A fixed annuity provides regular income payments that remain static over time regardless of market performance or other economic conditions; this makes them very predictable investment options for retirees looking for secure income streams from their savings without taking too much risk.

These various types of annuities have distinct characteristics which make them well suited for particular needs and objectives, so it pays to understand what you’re getting into before investing your hard earned money! Having said that, understanding how these products work will help guide you towards making an informed decision about whether an annuity is right for you – let’s take a look at calculating the present value of an annuity next.

Calculating The Present Value Of An Annuity

Incredible! We have now explored the various types of annuities. Now, it’s time to learn how to calculate the present value of an annuity.

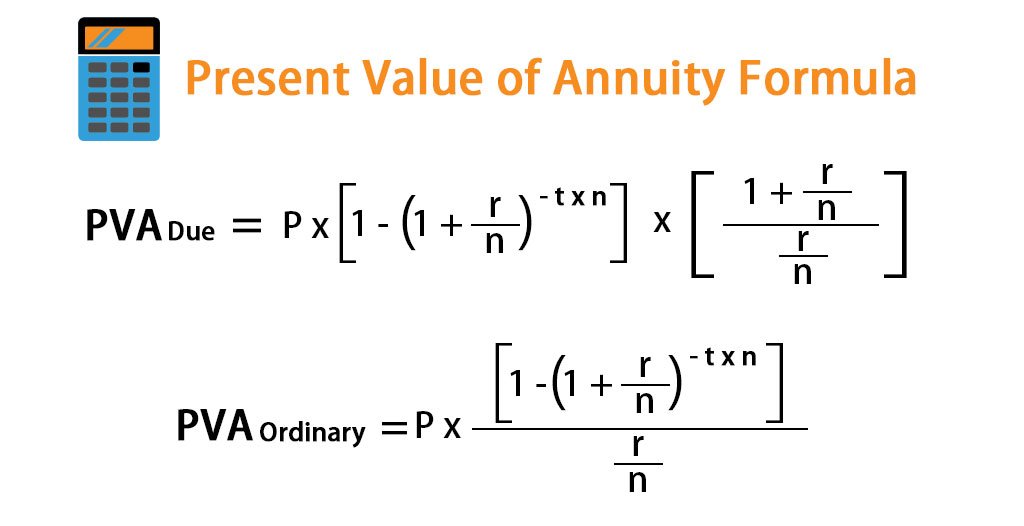

The key components in calculating the present value of an annuity include future payments, a rate of return (annuity rate), and compound interest over time. This combination helps us to understand what our money is worth today compared to what its value will be at some point in the future. To begin this calculation process, we must first derive the annuity formula.

To derive the annuity formula for calculations, you need to understand four terms: FV (future value), PV (present value), R (interest rate per period) and N (number of periods). Once these terms are understood, using them together with algebraic equations can help you arrive at the answer for your desired result. For example, if you want to know PV(Present Value), then you would use this equation: PV = FV/[1+R]^N .

It is critical that when doing any kind of analysis regarding annuities or other financial products that everyone understands their formulas so they can make well-informed decisions about their finances going forward. With all this knowledge on hand, let’s move onto deriving the annuity formula!

Deriving The Annuity Formula

When deriving the annuity formula, it is important to consider how compound interest affects present value. Compound interest allows for money to grow over time and must be taken into account when computing an annuity’s present value. To derive the annuity formula, we start with a single cash flow of R units at time t=0: PV(R) = R/(1+r)^0. We then look at two separate cash flows of R/2 each occurring one period apart from each other: PV(R/2 + R/2) = (R/2)/(1+r)^1 + (R/2)/(1+r)^0. Simplifying this equation yields: PV(R) = 2[(R/2)/(1+r)]/(1+r). Finally, by substituting n for 1/(1+r), we arrive at the annuity formula: PV(n){ [(1-((1+n)^{-T})) / n] } where n represents periodic compounded interest rate and T is the number of periods in which payments occur.

Annuity Formula Derivation| Right Now

Compound Interest

As we know, the Annuity Formula is a powerful tool for investing and calculating future wealth. But what if you want to take advantage of compound interest? To do this, one must understand how to use the Compound Interest Rate formula.

The Compound Interest Rate formula can be used to calculate how much money an investor could earn over time given three different factors: principal amount invested, annual rate of return, and number of compounding periods per year. It’s very important to have an understanding of these key elements in order to get accurate results from the Compound Interest Calculator.

In addition, it’s useful to look at some examples that utilize the Compound Interest calculations. Let’s say an individual invests $100 with a 5% annual rate of return compounded monthly for 10 years – using the formula, they would make a total profit of $65.45 after 10 years! This example shows just how beneficial compound interest can be when making long-term investments.

Understanding compound interest rates and accurately utilizing them are essential steps towards achieving your financial goals – whether you’re looking to save up for retirement or just planning out your budgeting needs. With the right knowledge and tools such as a Compound Interest Example or calculator, anyone can become savvy investors who make well-informed decisions about their money matters.

Factors Influencing Annuity Rates

When discussing annuity rates it is important to consider a variety of factors that can influence the rate. Interest rates, inflation rates and market conditions are all paramount in determining the annuity rate. When interest rates increase, this typically leads to an increase in returns on investments as well as higher annuity payouts. Similarly, when inflation rises or markets become more volatile, investors may demand higher returns which translates into increased annuity payments.

In addition to these macroeconomic considerations, other risk factors must also be taken into account such as life expectancy and investment objectives. For example, those with shorter life expectancies may opt for lower-risk investments with lower payouts than their counterparts who have longer life expectancies. Likewise, those looking for greater returns on their investments may choose riskier options that come with higher yields but also potentially larger losses if markets turn sour.

These various factors should always be considered before investing in an annuity product since they can greatly affect one’s financial outlook over time. Taking all of them into consideration will help ensure that you receive the best possible return for your money given current market conditions. With this information in hand we can move onto the next step: estimating future payments from an annuity policy.

Estimating Future Payments

“Time is money,” and annuities are no exception. Estimating future payments from an annuity requires knowledge of the factors that influence rate, as discussed in the previous section. By understanding these variables, one can accurately determine their estimated payment amount.

Here are five steps to consider when estimating future annuity payments:

- Assess the current market conditions

- Research past performance of similar investments

- Choose a time frame for your investment

- Calculate potential return on investment (ROI)

- Consider any additional taxes or fees associated with investing in an annuity

When it comes to predicting future returns, there is always risk involved due to changing economic conditions. However, by taking into account historical data and researching current trends, you can make educated decisions about which type of annuity will best suit your financial needs. It’s important to remember that immediate vs deferred annuities have different advantages depending on how long you plan to invest for; planning ahead and doing research can help ensure the most suitable choice for each person’s individual circumstances.

Immediate Vs Deferred Annuities

Annuities are a great way for individuals to save and prepare for retirement. There are two types of annuities available: immediate and deferred. Immediate annuity payments start immediately after the purchase is made, while deferred annuity payments begin at a future date chosen by the purchaser.

Immediate annuities provide guaranteed income during retirement and can be used to supplement Social Security or other pension benefits. Purchasers usually fund them with lump sums they have saved up over time, such as those from 401k accounts or inheritance funds. Deferred annuities allow purchasers to make regular contributions throughout their working years until they retire. The insurance company invests these contributions on behalf of the buyer, providing potential growth opportunities that may not be available through traditional investments like stocks or bonds.

Both immediate and deferred annuities offer advantages depending on one’s financial situation and goals. They both serve as an excellent source of retirement income, but it’s important for prospective buyers to do research in order to determine which type best suits their needs before making any purchases. With this knowledge, transitioning into discussing discrete vs continuous annuities will become easier for readers to understand.

Discrete Vs Continuous Annuities

Annuities can be either discrete or continuous. Discrete annuities involve payments of a fixed amount that are made periodically over a set duration, with the frequency determined by the terms of the contract. Continuous annuities involve making consistent payments for an indefinite period of time, usually on a monthly basis.

The formula used to calculate annuity payment depends on whether it is discrete or continuous. For discrete annuities, the formula is Present Value = Annuity Payment x (1 – 1/ [(1 + Interest Rate) ^ Number of Payments]) ÷ Interest Rate. The formula for continuous annuities is similar but involves taking derivatives and integrals; this makes calculation complicated compared to discrete annuities.

Discrete and continuous annuities both have their advantages and disadvantages depending on one’s financial needs. With discrete annuities, the interest rate remains constant throughout the term whereas in continuous annuities, the interest rate may change from month-to-month since there is no predetermined end date. On the other hand, calculating payments for a continuous annuity will take more effort than for a discrete one due to its complex mathematical nature.

Given these differences between them, it’s important to consider what type of structure best suits your particular needs before committing to an annuity plan. Moving forward, we’ll look at how variable vs fixed annuities vary in regards to risk and returns they offer investors.

Annuity Formula Derivation| Right Now

Variable Vs Fixed Annuities

When comparing annuities, one of the first distinctions to consider is whether you’re looking at a variable or fixed annuity. Fixed annuities offer steady returns and are backed by insurance companies, making them relatively low risk investments that guarantee a portion of your investment will be returned to you. Variable annuities however don’t have any guarantees on return rates and depend on the performance of underlying assets such as stocks, bonds and mutual funds. This can lead to higher potential earnings but also carries more risk than fixed annuities.

Both types of annuities come with different costs associated with them in terms of fees and surrender charges which need to be considered when deciding between the two. Additionally, some states limit how much money can be invested into certain kinds of variable annuities so it’s important to check local regulations before investing in this type of product.

Comparing the rate differences between fixed and variable annuities is an important part of assessing the overall value for each option since these relate directly to how much income you’ll get from your initial investment over time. With careful research and due diligence, investors can make informed decisions about which type best fits their individual needs.

Tax implications of purchasing an annuity are another key factor to consider when evaluating either a variable or fixed product.

Tax Implications Of Purchasing An Annuity

Purchasing an annuity can be a useful tool for retirement planning, but it’s important to understand the tax implications before you commit. Each type of annuity comes with its own set of benefits and drawbacks when it comes to taxation:

- Deferred Annuities:

- Contributions are not taxable in the year they’re made

- Withdrawals or earnings from deferred annuities are taxed as ordinary income

- Immediate Annuities:

- Payments received from immediate annuities are usually fully taxable as ordinary income

- Contribution amounts may be partially deductible depending on your financial situation

- Variable Annuities:

- Any investment gains within a variable annuity will typically remain untaxed until withdrawals begin

- When taking out money from a variable annuity, any withdrawals above the contributions are generally considered taxable income by the IRS

It’s important to consult with a qualified tax adviser prior to making any decisions about purchasing an annuity. Knowing how different types of annuities affect taxes is essential when it comes to determining which plan best fits your long-term goals and current financial circumstances. After understanding these potential tax implications, you’ll be better prepared to decide if an annuity is right for you and your retirement savings strategy.

Having discussed the tax implications associated with buying an annuity, we can now move onto exploring advantages and disadvantages of this product.

Advantages And Disadvantages Of An Annuity

An annuity is like a beacon of hope in the sea of retirement planning, shining brightly with its many benefits and advantages. As with any financial decision however, there are also drawbacks to consider before taking the plunge into an annuity. This section will explore both sides of this coin to provide readers with a holistic understanding of the pros and cons associated with investing in an annuity.

The main advantages of an annuity include tax-deferred growth potential, regular payment streams that can help supplement other sources of income, and protection against market volatility by providing peace-of mind during times of economic uncertainty. In addition, they offer liquidity options for those who may wish to access their money earlier than anticipated or need it for unexpected expenses. Annuities also have no annual contribution limits which makes them very attractive for individuals looking to accumulate larger sums over time without being restricted in how much they can contribute each year.

On the downside, annuities come with high fees due to surrender charges when accessed prior to maturity date as well as administrative costs and insurance premiums that reduce returns over time. There are also restrictions on how funds can be withdrawn from accounts which could limit flexibility if one’s needs change along the way. Additionally, since most annuities pay out only upon death or at some predetermined point in time (such as age 65), they do not provide immediate access to cash reserves should circumstances require emergency funding during life expectancy years.

With all these factors taken into consideration, investors must weigh whether an annuity fits within their overall retirement plan objectives while leveraging its full range of features – both positive and negative – accordingly.

Retirement Planning With An Annuity

Retirement planning is a crucial part of financial security. An annuity is one retirement option that can provide steady income in your later years. Here are some key points to consider when deciding whether an annuity is right for you:

- Calculate the present value of your annuity, which should be greater than the cost of purchasing it.

- Understand how inflation affects the future value of your payments and plan accordingly.

- Factor in tax implications on any payouts from the annuity.

Before making any decisions about investing in an annuity, make sure you understand all aspects involved and consult with a financial advisor or other professional if necessary. It’s important to ensure that this type of retirement plan fits into both short-term and long-term goals, as well as budget constraints. With careful consideration and proper planning, an annuity may be a great choice for secure retirement income. Moving forward, let’s take a look at alternatives to an annuity for retirement planning.

Annuity Formula Derivation| Right Now

Alternatives To An Annuity

The alternatives to an annuity are seemingly endless! With so many options available, it can be overwhelming for someone who’s looking for the best way to save for retirement. From life insurance policies and 401k retirement plans to mutual funds and pension plans, you’ll find something that fits your needs and goals.

One of the most popular alternatives is investing in a mutual fund. Mutual funds allow individuals to diversify their investments while minimizing risk through diversification. Additionally, they provide access to professionally managed portfolios with low costs. They also come with tax benefits such as capital gains exemptions when held over long periods of time.

Lastly, social security is another option for those seeking financial stability during retirement years. Social security provides guaranteed income throughout one’s lifetime regardless of economic downturns or stock market volatility. Furthermore, some portion of this income may not be taxable depending on individual circumstances making it an attractive alternative for retirees who want peace of mind without taking on additional risks.

No matter which route you decide to take, thoughtful planning and research will ensure that you make the right decision when selecting an investment vehicle suitable for your specific situation and objectives. Be sure to consult a professional if needed; knowledge is power when it comes to financial matters!

Frequently Asked Questions

What Is The Difference Between An Immediate And A Deferred Annuity?

An immediate annuity and a deferred annuity are two types of retirement planning tools that allow an individual to receive income and manage their tax implications. Both have advantages, but what is the difference between them?

The biggest distinction between an immediate and a deferred annuity is when payments begin. An immediate annuity begins paying out immediately after it’s purchased, usually as soon as within 30 days. The payment amount remains constant for however long the purchaser has chosen, so the owners can be certain about how much money they will get each month or year. On the other hand, with a deferred annuity, payments don’t start until some time in the future — typically at least one year from purchase date — making them suitable for longer-term savings goals such as retirement.

Another important aspect to consider when comparing these products is taxes. When income is received through an immediate annuity, only part of it may be taxable depending on its source; whereas a deferred annuity allows withdrawals to be taxed based on current rates rather than those set during original investment period. Additionally, if you plan to withdraw funds early from either type of product there could be penalties applied which should also factor into your decision making process when weighing up the benefits of both options.

It’s vital to understand all aspects of any financial strategy prior to committing – understanding the key differences between an immediate and deferred annuity helps ensure that you make informed decisions about your portfolio management for retirement planning purposes.

How Can I Use An Annuity To Help With Retirement Planning?

Retirement planning is an important part of financial health and security, and annuities can be used to help with this endeavor. An annuity is a contract between the investor and a financial institution where money is invested in exchange for periodic payments over time. There are several options available when it comes to annuities, each offering their own advantages and disadvantages.

Annuity options typically include immediate or deferred payment plans which provide different benefits depending on individual needs. Immediate annuities begin paying out right away while deferred annuities may not pay out until later down the road, usually after retirement age has been reached. Depending on the type of plan chosen, retirees can benefit from guaranteed income streams that last throughout their life span or those of their beneficiaries.

Aside from annuities, there are other types of retirement savings vehicles such as mutual funds, 401(k)s, IRAs, stocks and bonds that offer varying levels of risk versus reward. Annuity alternatives should always be considered before making any decisions about retirement planning as they have both pros and cons associated with them that must be weighed carefully at each stage of investing. While some people might find higher returns by avoiding these contracts altogether, others could use the added peace-of-mind that comes with a steady stream of income during their golden years.

It’s important to do your research when considering how best to approach retirement planning since everyone’s situation is unique; one size does not fit all! Taking into account current finances, long-term goals, budgeting habits and overall lifestyle will give you a better idea of what kind of investments will suit you best going forward.

Are There Any Tax Implications When Purchasing An Annuity?

Purchasing an annuity can be a great way to ensure financial stability in retirement, but are there any tax implications when doing so? It is important to consider the potential tax consequences of an annuity purchase before taking action. This article will discuss some of the most common annuity tax implications and what you should know when purchasing one.

When it comes to annuities, taxes are assessed differently depending on how they were funded and whether or not withdrawals have been taken. Generally speaking, annuities that are purchased with after-tax money do not incur additional taxes upon withdrawal; however, if an annuity was bought using pre-tax dollars (i.e., from a 401k plan), then income tax needs to be paid on each distribution at normal rates. Additionally, any earnings within the annuity may also be subject to taxation as well.

Furthermore, individuals who receive payments from an annuity must report them for federal income taxes every year – regardless of whether or not these payments come out of pre-tax or post-tax funds. In addition to paying regular income tax on this type of payment, those receiving payments may also need to pay a 10% penalty fee if they withdraw money prior to reaching the age of 59 1/2 years old.

It is important for anyone considering purchasing an annuity to be aware of all applicable taxes and penalties associated with their decision so that they can make informed decisions about their finances going forward. By understanding the various types of annuity tax implications upfront and planning accordingly, consumers can take full advantage of their investment while avoiding unnecessary financial hardship down the road.

What Are The Advantages And Disadvantages Of An Annuity?

An annuity is a retirement planning product that provides guaranteed income in the future. It can be used as an alternative to other investments, such as stocks and bonds, for those looking for stability during their golden years. When it comes to understanding the advantages and disadvantages of an annuity, there are many factors that need to be considered.

One of the primary advantages of an annuity is its tax implications; individuals may have access to certain tax deductions or credits when purchasing this type of investment product. Additionally, annuities provide regular payments over time, helping ensure retirees don’t outlive their savings. However, when considering any financial product, it’s important to understand both the pros and cons before making a purchase decision.

The potential drawbacks of investing in an annuity include fees associated with set-up and management costs which could reduce overall returns on investment. Furthermore, if market performance changes significantly during your retirement period then you might not receive expected returns from your annuity plan. There are also alternatives to using an annuity that you should consider carefully – such as stocks and bonds – prior to committing funds into one particular option.

Ultimately, it’s essential that anyone considering purchasing an annuity has all the facts they need in order to make a well-informed decision about how best to use their money for retirement planning purposes. With careful consideration of the advantages and disadvantages offered by different products available today, investors can help ensure they select the most suitable option for them based upon their individual circumstances.

Are There Any Alternatives To An Annuity?

Are you looking for a different way to save and secure your retirement? If so, there are alternatives to an annuity that could be just what you’re looking for. From long-term care insurance to life insurance policies, pension plans, mutual funds, and 401k plans – each option provides unique benefits. Read on to explore the options available when it comes to securing your financial future.

Long-term care insurance is designed to help cover ongoing medical costs associated with aging or disability. It can provide coverage for nursing home stays, assisted living facilities, in-home health aides, and more. Life insurance policies offer death benefit payments and cash value growth opportunities as well as various other advantages such as tax savings. Pension plans allow employees of companies or organizations to receive regular income from their employer after they retire from work. Mutual funds are investments portfolios made up of stocks, bonds, and other securities that can be used for retirement planning purposes. Finally, a 401k plan enables individuals to set aside money on a pre-tax basis which can then grow over time through investment earnings.

When considering these alternative options it’s important to assess each one carefully based on individual goals, risk tolerance level, timeline preferences and budget constraints — all while keeping a close eye on potential fees involved with each type of account or policy. Ultimately making sure you have the knowledge necessary before making any decisions will ensure that your chosen path is the most suitable one for reaching your desired outcome.

No matter which route you decide upon in order to reach your retirement goals – whether it’s an annuity or something else entirely – taking action today can make all the difference tomorrow!

Conclusion

In conclusion, when it comes to retirement planning, annuities can be a great tool. Investing in an annuity can lead to financial security and peace of mind during your golden years. However, there are certain tax implications that should be taken into consideration before signing up for any type of annuity plan. Additionally, the pros and cons should be weighed carefully so you can make the best decision for your unique situation.

It’s also important to recognize that there are alternatives to an annuity if one is not right for you. You may want to explore other options such as investing in life insurance or mutual funds depending on your risk tolerance level and goals for retirement. Whatever option you choose, it’s essential to do your research and understand all the terms associated with each product before making a final decision.

Ultimately, understanding how annuities work and taking advantage of their potential benefits – while being aware of their drawbacks – will enable you to develop a comprehensive plan for retirement success. Taking control of these decisions now could mean greater stability later in life; something we all strive towards!