Set It and Actually Forget It People are continuously on the lookout for investment possibilities that provide reliable returns while reducing the danger of losing their hard-earned money in an era of financial uncertainty. Annuities are one such product that has gained favor among long-term investors. read more

Annuities provide a unique blend of safety, guaranteed income, and hands-off investing, making them an excellent alternative for people wishing to safeguard their financial future with no effort. In this article, we will delve into the world of annuities, investigating the various varieties, their benefits, and how they might serve as a “set it and forget it” solution for your financial objectives.

What exactly are annuities?

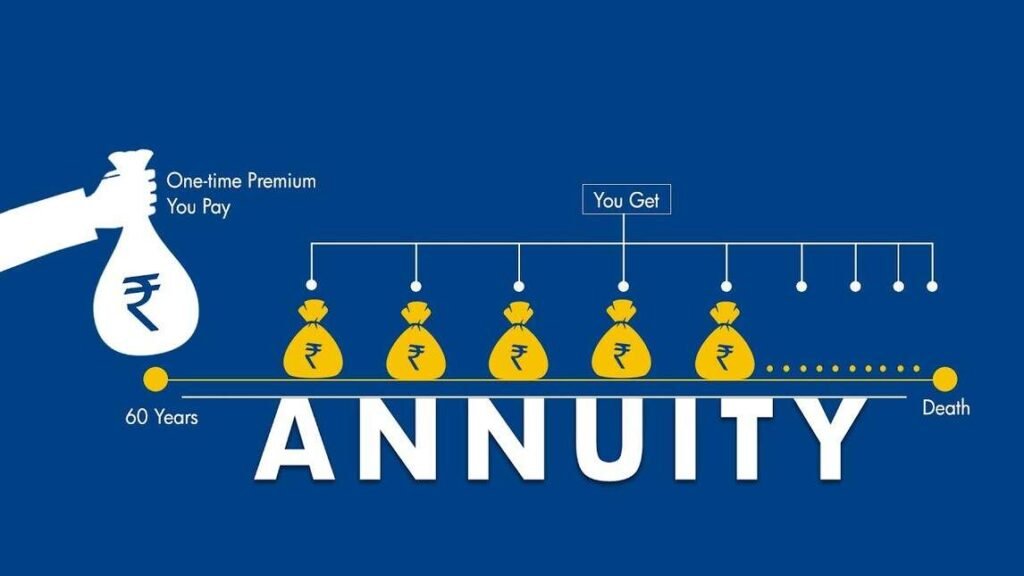

Annuities are financial products sold by insurance firms that promise a continuous income stream for a set length of time or for the remainder of the investor’s life. When you buy an annuity, you are simply purchasing a contract that guarantees to pay you a set sum of money at regular periods. Individuals looking to supplement their retirement income, protect their savings from market volatility, and enjoy a hassle-free investment experience may find this to be an appealing option.

Annuities and Their Varieties

Annuities come in a variety of formats, each catering to a different set of financial needs and risk tolerances. Fixed and variable annuities are the two main forms of annuities.

Fixed Annuities: A fixed annuity provides the investor with a guaranteed interest rate on their investment for a set length of time. Depending on the contract, this can run from a few years to their entire life. Fixed annuities offer certainty and are perfect for conservative investors who value stability and capital preservation over potential market profits. Set It and Actually Forget It

Variable Annuities:

On the other hand, variable annuities allow investors to invest in a variety of investment sub-accounts such as stocks, bonds, or mutual funds. The performance of these sub-accounts determines the annuity’s returns. This means that, while variable annuities may give larger returns, they also carry a higher risk owing to market swings. Set It and Actually Forget It

There are also delayed and immediate annuities, which refer to when the payouts begin. Deferred annuities begin payments later, but immediate annuities begin payments immediately after the investment is made.

Annuities Have Many Advantages

One of the primary benefits of annuities is the guaranteed income they give. Fixed annuities provide a consistent and predictable stream of earnings, ensuring that investors always have a safety net to fall back on regardless of market conditions.

Annuities provide tax-deferred growth, which means that investors do not have to pay taxes on interest or capital gains until they begin receiving payouts. This helps the investment to expand more quickly, compounding over time and eventually resulting to higher profits.

Market Volatility Protection: Annuities, particularly fixed annuities, provide a hedge against market swings. Investors can protect their investments and maintain their level of life by ensuring a specific return on investment regardless of market conditions. Set It and Actually Forget It

Annuities provide a number of payout alternatives, allowing investors to customize their income stream to match their unique needs. Annuities can be tailored to individual financial goals, whether they are seeking everlasting income or a fixed payment period. Set It and Actually Forget It.

“Set It and Forget It” Investing: One of the most appealing aspects of annuities is their lack of involvement. Investors can sit back and enjoy a consistent income stream without the need for continuous maintenance or monitoring once the initial investment is made and the contract parameters are agreed. Set It and Actually Forget It.

Leave a Reply