Criteria For Choosing Annuities In Portfolio Management Criteria for Choosing Annuities in Portfolio Management

Investing in annuities is an excellent way for individuals to diversify their retirement portfolio. It’s essential, however, to understand the various types of annuities available and which ones best-fit one’s individual needs.

This article will provide insight into criteria to consider when choosing an annuity for portfolio management purposes. The first step towards managing an investment portfolio with annuities involves understanding how each type works and its benefits.

From there, investors can narrow their choices based on factors such as liquidity, tax advantages, fees, and other variables. We’ll explore these considerations in more detail below to help you make informed decisions about your investments.

Types of Annuities

Regarding portfolio management, annuities can be an excellent option for investors. There are two main types of annuities: immediate and deferred.

An immediate annuity begins immediately after the purchase; the investor pays an upfront lump sum in exchange for fixed payments over time. read more

Deferred annuities don’t begin immediately; instead, they allow investors to save money upfront while earning interest until they’re ready to start receiving their regular income stream.

In addition to these two main types of annuities, there are variable and indexed ones. Variable annuities offer returns based on fluctuations in market indexes such as stocks or bonds. In contrast, indexed annuities provide potential returns based on changes in specific stock indices like the S&P 500® Index.

When choosing among these four options, investors should consider risk tolerance, desired return rate, preferred payment schedule, and tax implications. Criteria For Choosing Annuities In Portfolio Management.

Liquidity

Liquidity is an essential factor to consider when choosing annuities for portfolio management. It refers to the ease with which assets can be converted into cash without significantly affecting their value.

Annuities are typically illiquid investments, meaning they cannot easily be exchanged for cash in a short period and may have high surrender fees if cashed out before the maturity date. This could leave investors unable to access funds quickly should an unexpected need arise or if market conditions change suddenly.

Investors must carefully review all terms and conditions associated with any annuity product before purchase, including details about liquidity options and withdrawal restrictions. In some cases, provisions may allow early withdrawals after paying penalty fees; however, this option should be independent of a primary source of liquidity since it often comes at a steep cost that reduces returns substantially.

A financial professional can provide further guidance on assessing the appropriateness of an annuity’s liquidity features, given one’s individual needs and objectives.

Tax Advantages

When choosing annuities for portfolio management, one of the most important considerations is the tax advantage they provide. For investors looking to optimize their returns and minimize taxable income, understanding the tax implications of annuities can be essential.

Some types of annuities offer a range of benefits regarding taxes.

These include deferring taxes on earnings until you withdraw them from the account and having specific income streams that are exempt from taxation altogether.

However, fees may also be associated with these annuity products, which could reduce overall potential earnings over time.

Therefore, carefully researching each type of option available is vital to make an informed decision about whether or not annuities are suitable for your circumstances.

Risk assessment is another factor to consider when investing in any financial product, including annuities, so taking all aspects into account before making a decision should help ensure long-term success with your investments.

Fees and commissions

When considering annuities for your portfolio, it is essential to look at the fees and commissions that may accompany the purchase or management of those investments. These can range from annual maintenance charges to sales commissions the investor pays.

It’s essential to understand what you’re getting into before committing, as these costs often eat away at potential returns on investment.

It’s also worth exploring options for fee-based advisors who will charge a percentage of assets managed rather than transaction-based commissions. This arrangement best suits investors who want more personalized advice when selecting annuities.

Understanding all associated costs with an annuity can help ensure that it fits your overall financial goals and objectives. Investment Objectives

Investment objectives are the guiding principles for selecting annuities in portfolio management. They provide direction and clarity on achieving financial goals while avoiding potential pitfalls.

Investment objectives should be tailored according to an investor’s needs and risk profile.

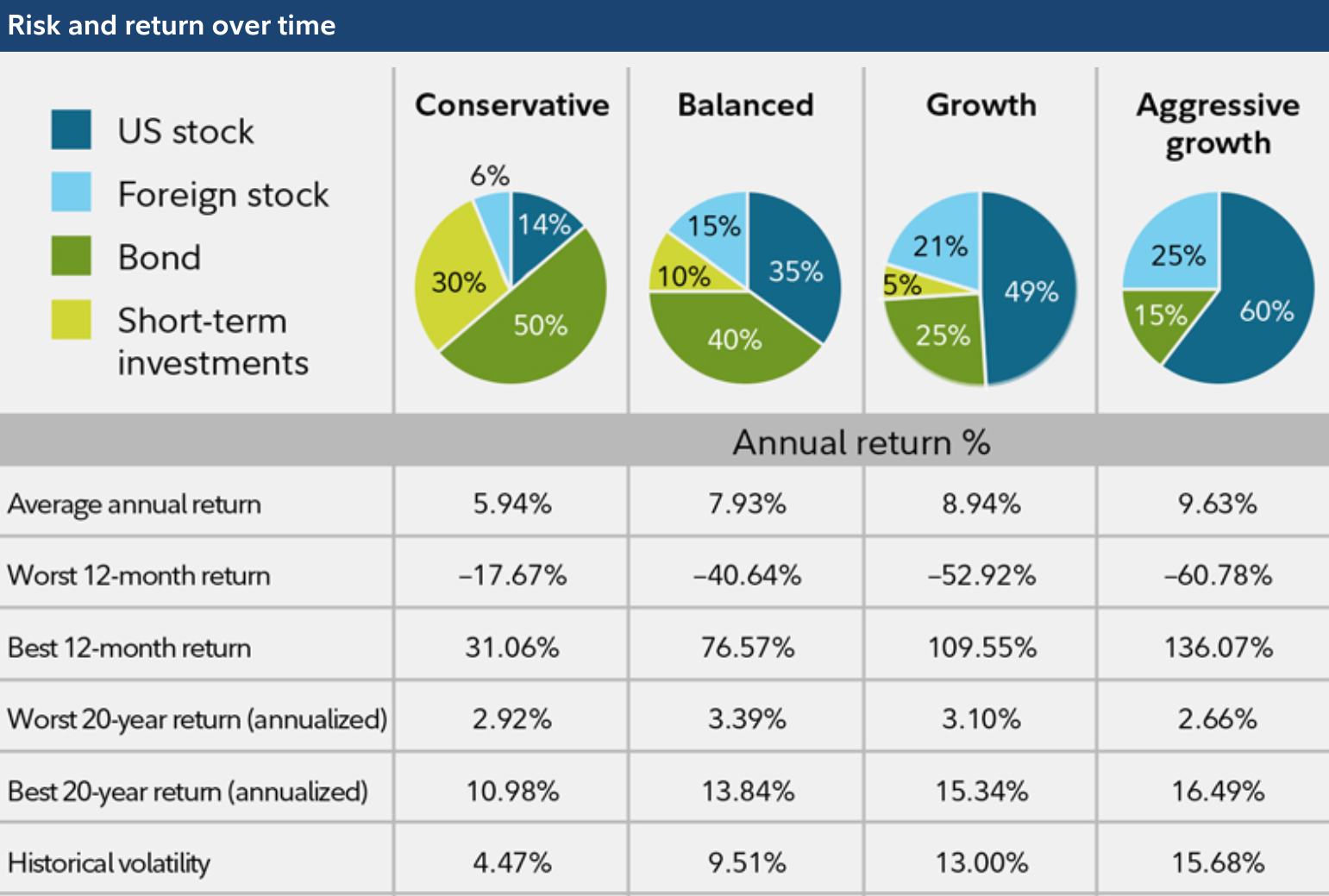

While some investors may prefer a conservative approach with low-risk investments, others might pursue more aggressive strategies with higher returns.

When choosing annuities, it is essential to consider factors such as the length of time until maturity, fees associated with the product or service provider, types of assets held within the annuity, income tax implications, surrender charges, and other costs associated with withdrawals before retirement age.

Additionally, ensure that all legal documents related to the annuity are thoroughly reviewed before signing to fully understand what you agree to.

All these elements will help you evaluate if assistance is suitable for meeting your personal investment objectives and can result in successful long-term portfolio growth.

Investment Time Horizon

When investing, understanding the time horizon for an annuity is essential. It will help to determine how long you should hold onto the annuity and when it could be appropriate to withdraw from or liquidate it.

Investors who plan on using their investments for short-term goals like retirement income should keep shorter investment horizons. At the same time, those with longer-term objectives may consider a longer-term option.

The length of an annuity’s term can also affect its performance since different investments have different return rates over specific periods.

The rate of return generally increases as the time gets longer due to compounding interest, but there are risks associated with this strategy as well.

It’s essential to evaluate current market conditions and your financial situation before selecting any annuity or setting up a portfolio management system that includes them.

Age Requirements

Regarding age requirements for annuities in portfolio management, some specific rules and regulations must be considered.

In most cases, individuals must be at least 59 1/2 years of age before they can begin collecting benefits from an annuity.

However, some states allow younger people to access their funds if a qualifying event has occurred, such as the death or disability of the policyholder.

In addition, when selecting an annuity, investors should consider how long they plan on holding onto the product.

Annuities come with surrender periods, which are when you purchase the contract and when withdrawals can begin without penalty fees being assessed against them.

Surrender charges vary by provider, so researching options before buying is essential.

Rate of return

When selecting an annuity for a portfolio, one should consider the rate of return they will receive.

In this case, time is money; if you wait longer to invest in an annuity, your returns could soar as high as the stars.

With each passing day, investors have more options and more significant potential gains from their investments.

Depending on what type of investor you are—risk-averse or adventurous—various strategies are available to maximize your earning potential with an annuity.

For those looking to play it safe, fixed-indexed annuities offer steady returns with minimal risk but limited upside.

On the other hand, variable annuities provide more aggressive opportunities with potentially higher returns depending on how markets perform over time.

Regardless of your path, careful consideration must be given to ensure the best chance at success when investing in an annuity.

Insurance Company Rating

When considering the rate of return, evaluating an insurance company’s rating is essential. This will help determine how reliable and effective their annuity products are as a part of portfolio management.

Insurance companies are rated by independent agencies that provide assessments and analyses of their financial stability and solvency levels.

Ratings from these agencies can give investors confidence in deciding which annuities they should choose for their portfolios.

The higher the ratings, the more financially sound the insurance company is perceived to be; however, even if an insurer receives lower ratings, that doesn’t necessarily mean its products or services aren’t good.

It simply means they need more attention when researching them. Investors should thoroughly examine each provider before deciding what annuities to include in their portfolio.

Consumer Protection Features

When selecting an annuity for portfolio management, consumer protection features are essential.

It is essential that investors understand the specific protections provided by their chosen product and the associated costs of these safeguards.

Some of the main protective measures offered include death benefits and financial guarantees such as principal protection or minimum payments.

Investors should also be aware of any restrictions on withdrawals or penalties related to early termination of the annuity contract.

In addition, most states have laws regarding insurance products that can provide added security against fraud and mismanagement.

By considering all available consumer protections when choosing an annuity, investors can ensure they select a product best suited to meet their needs while providing significant peace of mind.

Conclusion

When choosing annuities for portfolio management, there are many factors to consider. It’s essential to understand the types of annuities available and weigh the pros and cons of each one.

Additionally, liquidity, fees and commissions, rate of return, insurance company rating, and consumer protection features should all be considered when making a decision.

For example, if you’re an older investor looking for guaranteed income with minimal tax implications, investing in a fixed deferred annuity may be the best choice for your portfolio needs.

However, younger investors may opt for variable or indexed annuities that offer potentially higher returns while still providing some degree of safety.

Ultimately, understanding your investment objectives and researching different options can help you make the right decisions for your financial situation.

Leave a Reply