Index Mutual Funds Pros Cons And How They Work, Index mutual funds are an increasingly popular way to invest. They offer investors the chance to access a wide range of stocks and bonds without picking individual investments, enabling them to get broad exposure to the market.

This article will explore the pros and cons of index mutual funds and how they work.

Index mutual funds can be an excellent option for those looking for a passive investment strategy. They have low fees, provide instant diversification, and are tax-efficient—all advantages that make them attractive compared to other types of investments. Index Mutual Funds Pros Cons

However, some potential drawbacks should be considered before investing in index mutual funds. In this article, we’ll look at both sides so you can decide if it’s right for you. read more

What is an index mutual fund?

At first, glance, investing in an index mutual fund may seem daunting. But with the proper knowledge and understanding of the benefits, you can make a sound decision on whether or not to include this type of investment in your portfolio.

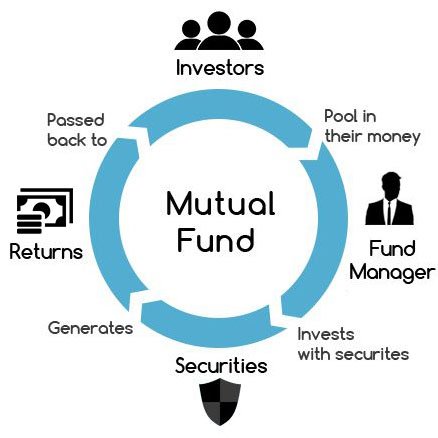

An index mutual fund is an investment option that allows investors to get broad exposure to a basket of other securities without picking individual stocks. These funds are typically managed passively, meaning they track a specific market index such as the Standard & Poor’s 500 Index (S&P 500). Index Mutual Funds Pros Cons

Investing in these types of funds offers tax benefits and diversification — two critical components for building a successful long-term portfolio. While there are some risks associated with any investment, by adequately researching and evaluating potential investments, you can minimize those risks while taking advantage of the opportunities offered by index mutual funds.

Advantages of Investing in Index Mutual Funds

One of the main advantages of investing in index mutual funds is that they have lower fees and tax implications than actively managed funds. This means you’ll be able to keep more of your money for yourself rather than have it go towards paying high management fees or taxes on capital gains. Index Mutual Funds Pros Cons read more

The fee structure associated with index fund investments generally consists of a single annual management fee, which is usually much lower than those associated with actively managed funds. Additionally, since most index funds are passively managed, there may be fewer taxable events as well, resulting in less tax liability overall.

Another advantage of this type of investment is that it allows investors to gain exposure to broad market indices without purchasing individual stocks and bonds. This dramatically simplifies the process, as all one needs to do is make a single purchase decision instead of researching and selecting numerous different securities. Index Mutual Funds Pros Cons

Furthermore, because these investments track major market averages such as the S&P 500 or Dow Jones Industrial Average (DJIA), they often offer more significant diversification benefits than other types of investments like ETFs or individual stocks or bonds. Ultimately, this can reduce volatility and risk within an investor’s portfolio while providing potential returns over time.

Disadvantages of Investing In Index Mutual Funds

Investing in index mutual funds may only sometimes be the best option for all investors. One of the main disadvantages to investing in such funds is that you will have to pay taxes on any capital gains or dividends earned from the investments, as with most other types of investment vehicles.

In addition, these funds typically carry a higher expense ratio than actively managed mutual funds, meaning they can take more out of your returns and leave you with less money overall.

Another area for improvement when investing in index mutual funds is that there are many different options available on the market, and choosing one can take time and effort. Financial advisors often suggest specific ones based on their client’s needs and situations.

If an investor chooses the wrong fund for their particular situation, they could lose money instead of gaining it. Therefore, investors should research carefully before committing to any investment decision involving index mutual funds. read more

It’s essential to remember that while index mutual funds come with advantages and disadvantages, they offer potential benefits for those who understand how they work and how they fit into their portfolios.

Before making any decisions regarding investments, individuals should consult with a professional financial advisor about which type of fund might be right for them and what risks may be involved.

What Types of Index Mutual Funds Are Available?

Index mutual funds are a great way to invest in global markets. They provide lower costs and higher tax efficiency than other investments and have no need for active management. Index tracking involves investing in an index fund that mirrors the overall market or specific sectors, such as technology, utilities, etc. This type of investment allows investors to gain exposure to the entire market or particular industries without picking individual stocks.

There are two main types of index mutual funds: passively managed and actively managed funds. Passively managed funds track indexes closely and require minimal maintenance from managers; they tend to have lower fees than their actively managed counterparts.

Actively managed funds use managers who attempt to outperform the benchmark index by selecting which securities should be included in the portfolio and when trades should be made; however, this often comes at a cost due to higher expenses associated with research and trading activities. Index Mutual Funds Pros Cons

No matter which type you choose, both can help you diversify your holdings while minimizing risk. Investing in index mutual funds also gives you access to professionally monitored portfolios, so you don’t have to worry about constantly managing them. read more

With these benefits come some drawbacks, though, such as limited upside potential if broader markets do not increase significantly in value over time. Index mutual funds offer an attractive option for those seeking low-cost diversification into various asset classes worldwide.

How to Choose The Right Index Mutual Fund

Many investors are wary of index mutual funds because they don’t think they can time the markets with them. However, index mutual funds offer many advantages that make them an excellent choice for those who want exposure to the entire market without taking on too much risk. Index Mutual Funds Pros Cons

By investing in all of the stocks or bonds included in the underlying indexes, you get diversification and can benefit from long-term capital gains tax advantages. Index mutual funds also allow you to invest in a wide variety of assets while avoiding the temptation of trying to time the markets.

This means you’re less likely to make emotional decisions regarding your investments, allowing you to remain disciplined and reap returns over the long term. Plus, since these funds have low management fees and no commissions, they’re one of the most cost-effective ways to build wealth through investing. Index Mutual Funds Pros Cons read more

Choosing an index mutual fund can be simple. Start by looking at different asset classes such as stocks, bonds, commodities, etc., then decide how much money you’d like to invest in each type of asset. Once you’ve decided on which assets you’d like exposure to and how much money you want to be allocated towards each one, investigate several index mutual funds based on their historical performance and see if any might fit your needs.

By doing research beforehand, being conscious about not timing the market, and carefully evaluating potential risks associated with individual securities within a given portfolio, selecting an appropriate index mutual fund should be relatively easy, whether it’s for retirement savings or another purpose! Index Mutual Funds Pros Cons

How to Invest In Index Mutual Funds

Investing in index mutual funds can be a great way to diversify your portfolio and take advantage of tax efficiency. Index funds are passively managed, which means they track the performance of an underlying benchmark. This makes them cheaper than actively managed funds, which involve more research and trading costs. As a result, investors benefit from lower management fees when investing in index mutual funds.

Index mutual funds offer some significant advantages, such as diversification benefits, low-cost transactions, and high liquidity. Diversifying across different asset classes reduces risk by spreading out the potential for losses due to market volatility or changes in industry sectors. Additionally, index fund investments tend to have higher tax efficiency since holdings don’t turnover as much as other types of investments. Index Mutual Funds Pros Cons

Ultimately, these factors make investing in index mutual funds attractive for those seeking long-term growth with less risk. Index Mutual Funds Pros Cons

In summary, index mutual funds offer numerous benefits, including increased diversification opportunities, lower transaction costs, and greater tax efficiency than traditional active investment strategies. These features make index mutual funds an ideal choice for anyone looking for long-term returns with relatively low levels of risk.

What Are the Risks of Investing In Index Mutual Funds?

Investing in index mutual funds comes with several potential risks. The most common risk, volatility risk, refers to the possibility that an investment’s value may go up or down due to market changes.

Another risk associated with investing in index mutual funds is tracking errors. This occurs when a fund fails to match its benchmark’s performance accurately and can result in underperformance of the index. Index Mutual Funds Pros Cons

It’s essential for investors to understand these risks so they can make informed decisions about their investments. Investing carries the risk of loss and the potential reward, and understanding the risks involved can help you decide if this type of investment is right for you.

Ultimately, it’s up to each investor to research and weigh their options before making any investments. Index Mutual Funds Pros Cons

Strategies for Managing Risk in Index Mutual Funds

Investing in index mutual funds can be a great way to get ahead financially, but managing risk is critical. When mitigating your exposure to potential losses and protecting your portfolio’s gains, there are few strategies more potent than those used by investors who utilize index mutual funds.

To maximize the benefits of these funds, it’s essential to consider some tried-and-true approaches for managing risk. One such strategy is taking advantage of tax-advantaged accounts like IRAs or 401(k) plans. These types of investments allow you to defer taxes on any earnings until retirement age, potentially giving you a more significant return on investment over time.

Additionally, utilizing different asset classes within an account can help diversify and balance out overall risk across multiple securities or markets. Using sophisticated risk profiling tools may also prove beneficial, as they offer insight into how much money should be allocated towards each security based on their respective risks and rewards profiles. With this knowledge in hand, adjusting investments accordingly can help ensure that you’re always open in one particular area while still allowing for growth opportunities elsewhere.

Overall, investing in index mutual funds offers many advantages when appropriately managed; however, understanding the financial risks associated with them is essential to ensure your investments are safe and secure. By leveraging tax-advantaged accounts and using various strategies, such as risk profiling tools, investors can mitigate their overall exposure while potentially maximizing returns in the long run. Index Mutual Funds Pros Cons

Conclusion

In conclusion, index mutual funds offer an excellent way for investors to gain access to the stock market without actively managing their investments.

The pros are that they provide broad diversification and lower fees than other types of investing.

On the other hand, risks can also be associated with them; however, by understanding those risks and implementing strategies to manage them, you can achieve success in your investment journey. Index Mutual Funds Pros Cons

Investing in index mutual funds is an easy and hassle-free way to start building wealth for yourself!

Leave a Reply